hyrdaruzhpnew4af.online

Prices

Best Mortgage Rates Oregon

The mortgage rates in Oregon are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 23 in your community, you can purchase or refinance with confidence. Current mortgage rates. Ready to calculate your homebuying budget? Here are the rates for. The current average year fixed mortgage rate in Oregon remained stable at %. Oregon mortgage rates today are 4 basis points higher than the national. MORTGAGE LOAN RATES ; 30 Year Fixed Rate, % · % ; Year Fixed Rate, % · % ; FHA 30 Year Fixed - Conforming, % · % ; VA 30 Year Fixed -. Start your Oregon home buying journey today with our Oregonmortgage calculator to get an idea of the current Oregon rates. Compare current Oregon mortgage rates. Find the lowest Oregon mortgage rates by reviewing personalized loan terms for multiple programs. Looking for home mortgage rates in Oregon? View loan interest rates from local banks, OR credit unions and brokers. We Love Dreamers. The following table shows current year Mountain View mortgage refinance rates. You can use the menus to select other loan durations, alter. Compare Oregon mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare loan. The mortgage rates in Oregon are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 23 in your community, you can purchase or refinance with confidence. Current mortgage rates. Ready to calculate your homebuying budget? Here are the rates for. The current average year fixed mortgage rate in Oregon remained stable at %. Oregon mortgage rates today are 4 basis points higher than the national. MORTGAGE LOAN RATES ; 30 Year Fixed Rate, % · % ; Year Fixed Rate, % · % ; FHA 30 Year Fixed - Conforming, % · % ; VA 30 Year Fixed -. Start your Oregon home buying journey today with our Oregonmortgage calculator to get an idea of the current Oregon rates. Compare current Oregon mortgage rates. Find the lowest Oregon mortgage rates by reviewing personalized loan terms for multiple programs. Looking for home mortgage rates in Oregon? View loan interest rates from local banks, OR credit unions and brokers. We Love Dreamers. The following table shows current year Mountain View mortgage refinance rates. You can use the menus to select other loan durations, alter. Compare Oregon mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare loan.

The current average year fixed refinance rate rose to %. Oregon's rate of % is 17 basis points higher than the national average of %. Today's. This is why it's imperative that you obtain the best possible rate. Contact Sammamish Mortgage today if you'd like a mortgage rate quote. Oregon Offers a Lot to. Mortgage Rates | ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. The professionals at Oregon's Best Mortgage (Demark Financial Services, Inc) have been making mortgage loans to Oregonians for the past three decades. We. Today's mortgage rates in Portland, OR are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. Today's Best Home Loan Rates · 10/6 ARM Jumbo as low as. %. APR. Apply Now · 5/6 ARM as low as. %. APR. Apply Now · 30 Year Fixed as low as. How high your credit score is; Your preferred type of home loan; Any extra loan fees and closing costs. Oregon Mortgage Lenders. Looking for the best mortgage. Using our free interactive tool, compare today's rates in Oregon across various loan types and mortgage lenders. Find the loan that fits your needs. sometimes finding a state program can help with rates, but I can't speak to Oregon Best Mortgage Rates · Best Lenders for First Time Home. Searching online Oregon's best mortgage rates might seem like a job in itself. Aurora Financial wants to make your search for low mortgage rates easier. Oregon Mortgage Rates. Current mortgage rates in Oregon are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. Find OR mortgage and refinance rates to compare lenders and save on your home loan. View current Oregon interest rates and get custom quotes today. Mortgage Purchase Rates ; 30 year fixed rate · % · % ; 30 year jumbo fixed rate · % · % ; 15 year fixed rate · % · % ; Homeroom · %. Today's mortgage rates in Oregon are % APR for a year fixed-rate loan and % APR for a year FHA loan. The national averages are % and %. Overview of Oregon Housing Market ; 5/1 ARM, %, %, ; 30 yr fixed mtg refi, %, %, + Portland mortgage rate trends · August 24, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. There is no shortage of reasons for purchasing a home anywhere in the Beaver State, but you definitely want to ensure that you are locking in the best possible. Best Mortgage Lenders in Oregon · Fairway Independent Mortgage Corporation · Geneva Financial · ClickStart Mortgage · Movement Mortgage · HomeStreet Bank. If you're looking to refinance your current mortgage, we've got the loan to help. By refinancing your mortgage at a lower interest rate, you could lower your. On the week of July 31, , the current average interest rate for a year fixed-rate mortgage increased 1 basis points from the prior week to %. The.

How Many Credit Cards To Build Credit Fast

The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The percentage of credit. It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. · Remember that your total available. The best approach with opening multiple credit cards is to maintain a consistent amount of spending that's 10% of your total credit limit or lower. Aim for balances under 30 percent. Multiple requests to obtain credit. If you suddenly apply to multiple credit cards, apply for a loan, and apply to increase. Having multiple credit cards is actually good for your credit score as long as you keep 0 or low balances on them. If you have not used most of. A secured credit card can help build credit history, as the bank reports your regular payments to credit bureaus. As you prove your reliability, you may then be. When managed properly, having multiple credit cards can allow savvy cardholders to maximize rewards and other benefits, such as interest-free financing and. The best way to reduce the interest owed on a credit card is to pay off the balance as quickly as possible. Otherwise, it may take many years to pay off. The ONLY WAY to build credit with any credit cards is TO PAY THEM ON TIME EVERY MONTH, or even better PAY THEM OFF TOTALLY each month. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The percentage of credit. It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. · Remember that your total available. The best approach with opening multiple credit cards is to maintain a consistent amount of spending that's 10% of your total credit limit or lower. Aim for balances under 30 percent. Multiple requests to obtain credit. If you suddenly apply to multiple credit cards, apply for a loan, and apply to increase. Having multiple credit cards is actually good for your credit score as long as you keep 0 or low balances on them. If you have not used most of. A secured credit card can help build credit history, as the bank reports your regular payments to credit bureaus. As you prove your reliability, you may then be. When managed properly, having multiple credit cards can allow savvy cardholders to maximize rewards and other benefits, such as interest-free financing and. The best way to reduce the interest owed on a credit card is to pay off the balance as quickly as possible. Otherwise, it may take many years to pay off. The ONLY WAY to build credit with any credit cards is TO PAY THEM ON TIME EVERY MONTH, or even better PAY THEM OFF TOTALLY each month.

First Progress Platinum Elite Mastercard® Secured Credit Card · Choose your own credit line – $ to $ – based on your security deposit · Build your credit. To build credit from scratch you'll need to establish a payment history that shows on your credit report and maintain it for at least six months. There is no simple answer as to how many credit cards you should have, and there can even be advantages to having more than one credit card. The best approach with opening multiple credit cards is to maintain a consistent amount of spending that's 10% of your total credit limit or lower. How many credit cards should I have to build credit history? You only need one credit card account to start building a credit history. By making on-time. How to build credit fast · Round out your credit file. If you have thin credit—with few or no credit accounts—you could report rent and utilities, as well as. For example, spreading debt across multiple cards can actually help build good credit. That's because your credit utilization ratio (i.e. Key Takeaways · You need at least one credit card so you can build credit, conveniently make purchases, and earn rewards on everyday expenses. · Having at least 2. Build your credit history faster · Get a credit card and use it on a regular basis. · Always pay your bills on time. · Pay your bills off in full whenever possible. Improving your credit score with a credit card · Build your credit history · Use a mix of credit types · Keep credit available. How to build credit fast · Round out your credit file. If you have thin credit—with few or no credit accounts—you could report rent and utilities, as well as. Pay your bills on time. Your payment history has the single greatest impact on your score, so it's vital to make your credit card and loan payments by the due. Secured credit cards require cash deposits. People often use a secured credit card to build credit. Learn how to get a secured card, their pros, cons and. Paying those cards off on time helps build your credit score, which has a huge influence on your ability to get a loan for a car or a mortgage to buy a house. Multiple cards offer more ways to pay and different types of rewards, from miles and points to cash back. Credit cards can also help your credit score — or hurt. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Have a mix of credit types. FICO prefers to see consumers with both installment loans and credit cards. If you are repaying student loans or have a car loan or. good cards are generally the best number. As long as only 1 or 2 of them report balances (and at least 1 reports a balance) and you do not. A credit builder credit card is a type of credit card that's designed to allow you to improve your credit score, in the event that you have a poor credit. How many credit cards should I have to build credit history? You only need one credit card account to start building a credit history. By making on-time.

10 000 Invested For 30 Years

Consider the number of years you expect will elapse before you tap into your investments. The longer you have to invest, the more time you have to take. Say you have invested INR 10, for 10 years. You earn 5% interest on your investment and your interest gets compounded annually. So, in the first year you. hyrdaruzhpnew4af.online provides a FREE return on investment calculator and other ROI calculators to compare the impact of taxes on your investments. Consistent investments over a number of years can be an effective strategy to accumulate wealth. The Standard & Poor's ® (S&P ®) for the 10 years ending. 10 Months1 year5 years10 years15 years. ,, year per share of stock held by the value of one share of stock. Share price. The. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending. Determine how much your money can grow using the power of compound interest. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. Consider the number of years you expect will elapse before you tap into your investments. The longer you have to invest, the more time you have to take. Say you have invested INR 10, for 10 years. You earn 5% interest on your investment and your interest gets compounded annually. So, in the first year you. hyrdaruzhpnew4af.online provides a FREE return on investment calculator and other ROI calculators to compare the impact of taxes on your investments. Consistent investments over a number of years can be an effective strategy to accumulate wealth. The Standard & Poor's ® (S&P ®) for the 10 years ending. 10 Months1 year5 years10 years15 years. ,, year per share of stock held by the value of one share of stock. Share price. The. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending. Determine how much your money can grow using the power of compound interest. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below.

Let's say you invest $1, in an account that pays 4% interest compounded annually. How much will you have after five years? In order to calculate the future. Use our investment calculator to calculate the return for your investments. Adjust your amount, rate of return and years invested to calculate additional. If you invest Rs per month through SIP for 30 years at an annual expected rate of return of 11%, then you will receive Rs.2,83,02, at maturity. Popular. Thirty-year-olds investing for a 9% yearly return only need to invest $ each month to have a million dollars by age 65, but year-olds, as we can see. Find out what you should expect if you invest $ in the S&P exchange-traded fund and wait 20 years. by the end of 5 years, and by the end of 30 years, to $1, That's the With the bonds, the company agrees to pay you back your initial investment in ten. Error: Enter a monthly income less than $16,, Month Year. error icon. Error: Fill only 2 input fields. Remove 1 entry and click Calculate your results. How Much Will $10, be Worth in 30 Years? ; Rate, Value ; $10, at % for 30 years, $34, ; $10, at % for 30 years, $37, ; $10, at % for 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, Investment Year Investment Date, Original Shares, Original Value. After 10 years you'd have $13, You'd earn $3, in interest. After 20 Lorenzo and Sophia both decide to invest $10, at a 5% interest rate for five. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending December And since we do have apps now, where are you putting in 10k expecting it to be worth 1M+ in 20 years? How does the investment rate of return affect the value of 10k invested for 30 years? ; Investment Profile, Value after 30 Years ; 10k at 1% for 30 years, 13, Initial Investment. Amount of money you have readily available to invest. Step 3: Growth Over Time. Years to Grow. Length of time, in years, that you plan to. 30; Investment Year. , , , , , , , , , , , , , , , , , , , , , ( (ET) approx.). Statistics · Statistics · Daily Digest · Exchange rates Enter the year in which the money was first invested. End year. Enter the. 10 years, 11 years, 12 years, 13 years, 14 years, 15 years, 16 years, 17 years, 18 30 years, 31 years, 32 years, 33 years, 34 years, 35 years. Select an. Investment Day. 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, Investment Year. , Emily, 30 years old. Emily has enough money saved up for a financial buffer He believes his average return on investment will be around 10%. The. years 10 years 0 10k 20k 30k 40k 50k. This calculation is based on the accuracy and completeness of the information you enter and on certain assumptions. The.

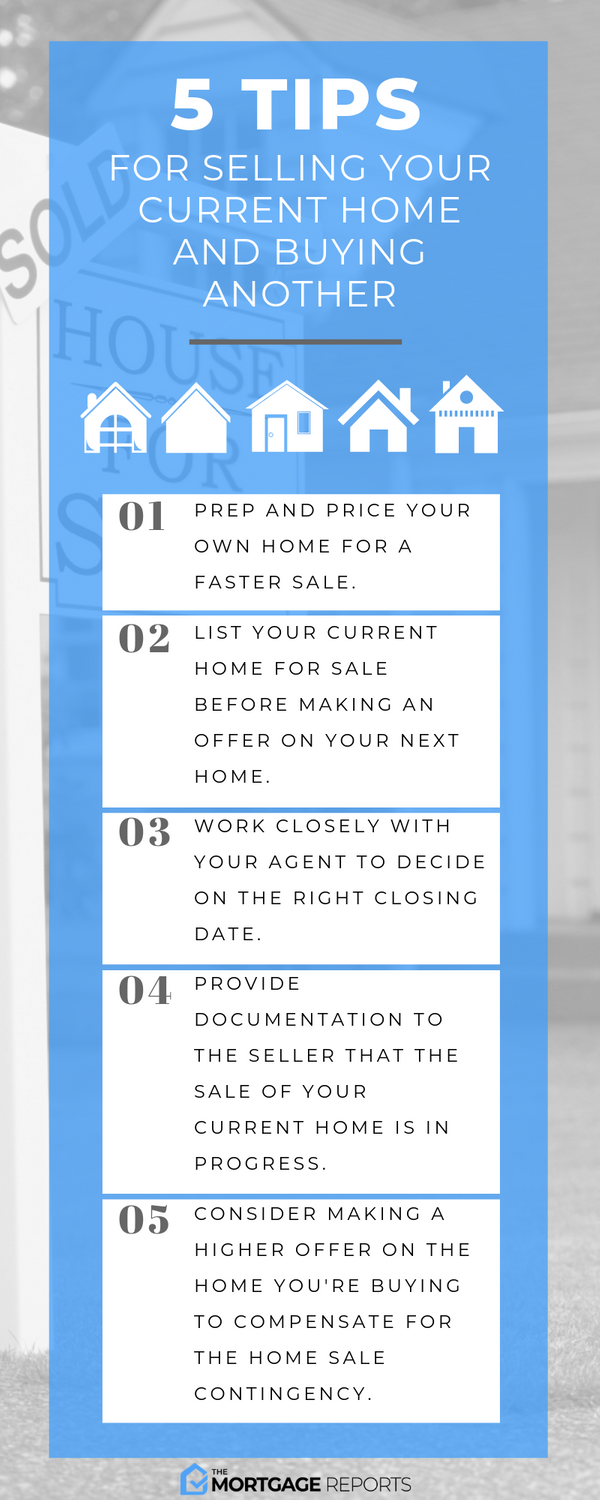

How To Sell Your Home To Buy Another

In this article, we'll teach you the least stressful way to sell and buy a house at the same time. We'll also help you know whether you should look to buy or. Selling your home with an existing mortgage balance is certainly possible. In fact, many homeowners do just that if they're looking to upsize or downsize before. Negotiate the closing date. You found a buyer for your current home—whew! · Set up a rent-back agreement. · Stay with family or friends. · Pay for temporary. Sell your house at a competitive price in a traditional home sale. Get paid We buy your home and lease it right back to you. It's as simple as that. Here's what I did last month: put my house up for sale, put in an offer on a new house with a 60 day close, accept an offer on my old house with. Selling your home with an existing mortgage balance is certainly possible. In fact, many homeowners do just that if they're looking to upsize or downsize before. In the United States, it is possible to use the proceeds from selling your old house to buy a new one. If the property being sold is your. Start your house selling journey with Zillow's expertise. Pick the best home selling option for you: sell with a Zillow partner agent, get a cash offer. Buying a house before selling: If you have enough equity, you may be able to buy the next home first (perhaps using a line of credit on the existing home or a. In this article, we'll teach you the least stressful way to sell and buy a house at the same time. We'll also help you know whether you should look to buy or. Selling your home with an existing mortgage balance is certainly possible. In fact, many homeowners do just that if they're looking to upsize or downsize before. Negotiate the closing date. You found a buyer for your current home—whew! · Set up a rent-back agreement. · Stay with family or friends. · Pay for temporary. Sell your house at a competitive price in a traditional home sale. Get paid We buy your home and lease it right back to you. It's as simple as that. Here's what I did last month: put my house up for sale, put in an offer on a new house with a 60 day close, accept an offer on my old house with. Selling your home with an existing mortgage balance is certainly possible. In fact, many homeowners do just that if they're looking to upsize or downsize before. In the United States, it is possible to use the proceeds from selling your old house to buy a new one. If the property being sold is your. Start your house selling journey with Zillow's expertise. Pick the best home selling option for you: sell with a Zillow partner agent, get a cash offer. Buying a house before selling: If you have enough equity, you may be able to buy the next home first (perhaps using a line of credit on the existing home or a.

To sell your home, think like a salesperson, not like a homeowner. · Do your research and set a realistic asking price. · Wait until spring if you can. · Take time. There are three ways to sell your home and buy another home without having to move twice. Sometimes moving twice is a better option, but a lot of people really. If you see a property you want to buy but have not sold your current property, you can put in an “offer to purchase” on the new property and make the purchase. Visit RBC Royal Bank to learn about different strategies to help you sell your current home and buy the next one. 1. Draft a rent-back agreement · 2. Write a contingency into your contract · 3. Take out a Home Equity Line of Credit (HELOC) · 4. Get a bridge loan. How to Buy a House While Selling Your Own: Avoiding Two Mortgages · 1. Draft a rent-back agreement · 2. Write a contingency into your contract · 3. Take out a Home. The easiest way to buy out a co-owner is to set up an agreement before you purchase the home. This agreement can specify how you divide the house. Take out a bridge loan to help “bridge” the gap between the time you sell one property and purchase the next. Most commonly considered by homeowners in. One solution is for you to buy out the other co-owner(s), After you have bought out the co-owner(s), it is wholly your property to do with as you wish. If your. If you're looking to buy a second home but are short of ready cash, you might consider tapping your equity stake in your existing home to help fund your new. Look into a HELOC to use your equity and then pay it off when you sell. Then you can buy without a contingency, unless your income doesn't allow. Negotiate the closing date. You found a buyer for your current home—whew! · Set up a rent-back agreement. · Stay with family or friends. · Pay for temporary. You can then use that money for any purpose you wish, including buying a second home or an investment property. However, using a home equity loan to buy another. You can sell a home even if you've taken out a home equity loan (or home equity line of credit). · In such cases, you can use the money you receive for the sale. Before you start making plans to buy and sell a house at the same time you need to get a clear idea of how much your current home is worth. So start online with. It's fairly common to choose to buy a property first, but make the sale subject to selling your existing property. This means you are making an offer, with the. With up to $, available tax free, you could use the money to make a down payment on another home, pay down problematic debt, increase your stock portfolio. Signs That It's Time to Sell Your House · You have significant equity in the home · You have cash for down payment and closing costs · The market is good for. Before you start making plans to buy and sell a house at the same time you need to get a clear idea of how much your current home is worth. So start online with. Having 2 homes may also mean having 2 mortgages, which can potentially create a financial burden. Before buying a second home, experts suggest paying off high.

How Can I Make Payments On Amazon

To manage payment methods: In Your Account, select Your Payments. Choose one of the following: To add a payment method, select Add a payment method. Amazon Pay is an online payment service that makes checkout on your site fast and secure for hundreds of millions of Amazon customers around the world. This offer to enroll in an installment plan applies only to qualifying products where the "Monthly Payments" option is available on the product detail page. Shop Amazon products online and in-store. Choose how you pay. Choose to pay over 6 or 12 months or in 4 interest-free payments. No late fees. You don't really get to choose to make the payments. They will auto-debit the payments. And that's coming out of the account whether you. Using Amazon Pay for seamless online payments - Securely shop on non-Amazon sites with your Amazon credentials. Easily checkout using your Amazon payment. hyrdaruzhpnew4af.online accepts a variety of payment options, including credit and debit cards. The following payment methods are available for use. Shop products eligible for monthly payments · Kitchen & Dining · Bedding · Bath · Furniture · Home Décor Products · Wall Art · Lighting & Ceiling Fans · Seasonal Décor. Check out with Amazon Pay and then select Affirm as your payment method. Enter a few pieces of information for a real-time eligibility decision. To manage payment methods: In Your Account, select Your Payments. Choose one of the following: To add a payment method, select Add a payment method. Amazon Pay is an online payment service that makes checkout on your site fast and secure for hundreds of millions of Amazon customers around the world. This offer to enroll in an installment plan applies only to qualifying products where the "Monthly Payments" option is available on the product detail page. Shop Amazon products online and in-store. Choose how you pay. Choose to pay over 6 or 12 months or in 4 interest-free payments. No late fees. You don't really get to choose to make the payments. They will auto-debit the payments. And that's coming out of the account whether you. Using Amazon Pay for seamless online payments - Securely shop on non-Amazon sites with your Amazon credentials. Easily checkout using your Amazon payment. hyrdaruzhpnew4af.online accepts a variety of payment options, including credit and debit cards. The following payment methods are available for use. Shop products eligible for monthly payments · Kitchen & Dining · Bedding · Bath · Furniture · Home Décor Products · Wall Art · Lighting & Ceiling Fans · Seasonal Décor. Check out with Amazon Pay and then select Affirm as your payment method. Enter a few pieces of information for a real-time eligibility decision.

Make a one-time payment · Go to Your Amazon Card Page. · Select Make a payment or select Manage Card. If you select Manage Card, then choose Make a payment from. Installments helps your customer to pay for any product or services at your site in regular monthly payments, called equitable monthly installments (EMI). Amazon Pay with Shopify Payments is a fast, easy, and trusted way for your customers to make purchases on your online store by using payment and shipping. You can only split payment between a credit/debit card and an Amazon gift card. While you won't be able to use two of your own cards for an Amazon purchase, you. Accepted Payment Methods · Unknown Charges · Print an Invoice · Payment Issues and Restrictions · Payment Plans · Monthly Payments Terms and Conditions · hyrdaruzhpnew4af.online Payments, whether due to insufficient sales, order refunds, fees, or monthly charges, can be made via the Make a Payment tab in your account. Unified Payment Interface (UPI) · Credit/Debit card · Amazon Pay Balance · Amazon Pay Later · Net Banking · Easy Monthly Installments (EMI). Amazon has its own Buy Now, Pay Later program called Monthly Payments. This program allows you to split the cost of an item across five months with no interest. Shop conveniently with Amazon Pay, accepting major credit and debit cards (Visa, MasterCard, American Express, Visa Electron, Delta, Maestro) and SEPA. I've used Amazon Monthly Payments 5 times already for items between $ and $ Always payed on time with no issues. To be honest I don't know the exact. Make simple and easy payments. Download the Affirm app or sign in at hyrdaruzhpnew4af.online We'll send you reminders so you don't forget to make your payments. Shop now. Accepted Payment Methods · Visa (including the Amazon Rewards Visa Signature Card) · Amazon Store Card · Amazon Secured Card · MasterCard/EuroCard · Discover Network. Buy now, pay later at Amazon with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. Pay for your purchase of eligible products with equal monthly payments and 0% APR. No interest will be charged on the promotional purchase balance. Select Installment Payments or Revolving Payments · Add the item or items you want to purchase to your cart and select Proceed to Checkout. · Open Payment method. Installments helps your customer to pay for any product or services at your site in regular monthly payments, called equitable monthly installments (EMI). Amazon Pay is a service that lets you use the payment methods already associated with your Amazon account to make payments for goods or services on third-party. PayPal debit cards are now accepted on Amazon, allowing personal and business account holders to make purchases. Apply or request a card to use this. Visit the Monthly Payments page and click “Enable monthly payments.” Find an eligible product and select monthly payments. Learn how to accept payments with Amazon Pay. Amazon Pay is a wallet payment method that lets your customers check out the same way as on hyrdaruzhpnew4af.online

Laptop That Will Last 10 Years

What is the average lifespan of a laptop? Your laptop should last at least years, but it can last even longer depending on: We'll break down each of. And user can decide that depending on his hardware and his needs. Below is a comparison that I did on my year-old laptop, between Linux OS. If you expect to lose 20% of laptops each year, after a decade, about 10% of laptops will still work after a decade. It's more if you are willing to work around. ^ Jump up to: "Toshiba shuts the lid on laptops after 35 years". BBC News. Retrieved ^ Ventura, Felipe (15 May ). "Itautec. A good lenovo will do, they're tough as nails. I'd say anything i5 and up with 8gb ram or better Easy to dissemble usually. [10] " Surface Laptop comes with 39W Surface power supply. Fast charging Actual charge time will vary based on operating conditions. Measured. Gaming Laptops can last for many years, however, I imagine that long before that, games will cause them to become obsolete. This laptop will meet the minimum requirements · This laptop will be outdated quickly and may only be good for years. · Products like AutoCAD, MATLAB and. Even powerful workstations and gaming laptops, once lucky to last an hour or two away from a wall socket, can now get you through an eight-hour workday. . What is the average lifespan of a laptop? Your laptop should last at least years, but it can last even longer depending on: We'll break down each of. And user can decide that depending on his hardware and his needs. Below is a comparison that I did on my year-old laptop, between Linux OS. If you expect to lose 20% of laptops each year, after a decade, about 10% of laptops will still work after a decade. It's more if you are willing to work around. ^ Jump up to: "Toshiba shuts the lid on laptops after 35 years". BBC News. Retrieved ^ Ventura, Felipe (15 May ). "Itautec. A good lenovo will do, they're tough as nails. I'd say anything i5 and up with 8gb ram or better Easy to dissemble usually. [10] " Surface Laptop comes with 39W Surface power supply. Fast charging Actual charge time will vary based on operating conditions. Measured. Gaming Laptops can last for many years, however, I imagine that long before that, games will cause them to become obsolete. This laptop will meet the minimum requirements · This laptop will be outdated quickly and may only be good for years. · Products like AutoCAD, MATLAB and. Even powerful workstations and gaming laptops, once lucky to last an hour or two away from a wall socket, can now get you through an eight-hour workday. .

Inspiron is a perfect choice for budget users where XPS can be used for high-end usage and of course Alienware for gamers. Also according to recent lists, Dell. Can a laptop last over 10 years? It's possible for a laptop to last over 10 years, but it's not very common. Most laptops have a lifespan of around LTS stands for long-term support — which means five years of free security and maintenance updates, extended to 10 years with Ubuntu Pro. You can also run. Once you know which operating system you want and have some idea of the software you're going to run, you can figure out the minimum hardware specifications you. I have an ASUS ROG jx built in I'm using it as a media server, so, it is never shutdown or put to sleep how long will it last? Most business class notebooks are incredibly durable and the market offers replacement parts for 10 of 15 year old devices. Windows 10 · Windows 11 Home in S Mode · Chrome OS · Windows 7. Model Family Some features will run through your laptop battery more. The Best portable inch gaming laptops and ultrabooks. In the past, the Alienware 13 was for many years the only inch performance laptop you could get. It. Lenovo Tab M10 Plus laptop model from previous years is included in the Annual sale? The laptops included in Lenovo's Annual sale can vary from year to year. Inspiron is a perfect choice for budget users where XPS can be used for high-end usage and of course Alienware for gamers. Also according to recent lists, Dell. How long should a laptop last? Based on the average laptop life expectancy, a new laptop should last between years. But note, this is purely based on the. Can a laptop last over 10 years? It's possible for a laptop to last over 10 years, but it's not very common. Most laptops have a lifespan of around This laptop will meet the minimum requirements · This laptop will be outdated quickly and may only be good for years. · Products like AutoCAD, MATLAB and. ^ Jump up to: "Toshiba shuts the lid on laptops after 35 years". BBC News. Retrieved ^ Ventura, Felipe (15 May ). "Itautec. Gaming Laptops can last for many years, however, I imagine that long before that, games will cause them to become obsolete. More expensive laptops with high-end hardware will typically give your laptop a longer lifespan, adding as much as a year or two. They handle new software. HP '' Anti-Glare HD Laptop| Intel Quad-core Processor | 32GB RAM | Office 1-Year | Up to 11 hrs Long Battery | Win11 (Black, GB SSD + GB. MSI announced the MSI Claw 8 AI Plus earlier this year, and it could be prepared to give the Asus ROG Ally X a run for its money. Gaming Laptops & PCs · Lenovo. A laptop computer or notebook computer, also known as a laptop or notebook, is a small, portable · Laptops can run on both · The word laptop, modeled after the. Dell Monitors are #1 Worldwide for 10 Years. See everything. Do anything. Shop Now. DELL MONITORS Where would you like to shop? Switch to USA Stay on Canada.

Army National Bank

Bank of America offers a variety of financial solutions and resources for active duty military, military members, and their families. Learn more about our. Military Service banking representatives, is responsible for the oversight and management of Community Bank U.S. Army · U.S. Coast Guard · U.S. Navy · U.S. Armed Forces Bank (AFB) is a bank servicing members of the United States Armed Forces and their family members. Armed Forces Bank. Industry, Banking. Fort Hood National Bank (FHNB), a division of First National Bank Texas, has stood apart as a leader in military banking. The story of the Office of the Comptroller of the Currency and the national banking system begins in , when the National Currency Act was passed by. ARMY NATIONAL BANK in Arlington, reviews by real people. Yelp is a fun and easy way to find, recommend and talk about what's great and not so great in. Discover banking that serves your military life, with no-fee banking, no annual fee credit card options, rewards and optimized mortgage and lending rates. Armed Forces Bank's Digital Banking app helps you do more on your smartphone or tablet. Deposit checks, transfer funds, check balances, receive alerts, view. ANB Bank is a bank like no other with the strength, talent, commitment, and security to fulfill our business and personal customers' financial needs. Bank of America offers a variety of financial solutions and resources for active duty military, military members, and their families. Learn more about our. Military Service banking representatives, is responsible for the oversight and management of Community Bank U.S. Army · U.S. Coast Guard · U.S. Navy · U.S. Armed Forces Bank (AFB) is a bank servicing members of the United States Armed Forces and their family members. Armed Forces Bank. Industry, Banking. Fort Hood National Bank (FHNB), a division of First National Bank Texas, has stood apart as a leader in military banking. The story of the Office of the Comptroller of the Currency and the national banking system begins in , when the National Currency Act was passed by. ARMY NATIONAL BANK in Arlington, reviews by real people. Yelp is a fun and easy way to find, recommend and talk about what's great and not so great in. Discover banking that serves your military life, with no-fee banking, no annual fee credit card options, rewards and optimized mortgage and lending rates. Armed Forces Bank's Digital Banking app helps you do more on your smartphone or tablet. Deposit checks, transfer funds, check balances, receive alerts, view. ANB Bank is a bank like no other with the strength, talent, commitment, and security to fulfill our business and personal customers' financial needs.

hyrdaruzhpnew4af.online Network. Air Force · Army · Coast Guard · Marine Corps · National Guard · Navy · Space Force. About hyrdaruzhpnew4af.online About Us & Press Room · Mobile. Armed Forces Bank's Digital Banking app helps you do more on your smartphone or tablet. Deposit checks, transfer funds, check balances, receive alerts, view. In the J.D. Power U.S. Retail Banking Satisfaction Study, United Military Resources · Fraud Prevention Tips · Contact Us. Legal. Accessibility. Memphis, a strategic port city, fell to Union forces after a dramatic gunboat battle on the Mississippi on June 6, The occupying army made U.S. dollars. We're not just your official bank, we're here to help Canadian Defence Community Members and their families make real financial progress. FDIC Insured. Careers · Investor Relations · Locations · Contact Us · Social; Search. Old Second Bank Army Trail Rd. MAP. P Lobby. AMBA's membership includes large and small national- and state-chartered banks, most operating on military installations and all insured by the FDIC. AMBA. Military banks serve where our military serves. Whether through on-base banks in the United States or abroad or through electronic bank networks like the Armed. ABOUT US. FSNB, formerly known as Fort Sill National Bank, has a tradition of distinguished banking service to both the military and civilian communities. In. First Heroes National Bank (FHNB), a division of First National Bank Texas, has stood apart as a leader in military banking. The Association of Military Banks of America is comprised of regular and associate member banks and corporate members. First National Bank is proud to provide programs and partnerships to help ensure the military and veteran communities have access to the financial resources. Active Army Direct Deposit Available Dates: January, February, March, April, May, June, July, August, September, October, November, December. Exchange Bank has been a strong and stable community bank since , five years before Kansas was admitted to the Union as a free state. Our customers can also bank with us worldwide - anytime, any place, anywhere - 24 hours a day, 7 days a week, days a year. Website: hyrdaruzhpnew4af.online Open a Bank Smartly Checking account and you'll automatically be enrolled in the Smart Rewards Plus tier, 1 at a minimum, regardless of your account balance. Navy Federal Credit Union is an armed forces bank serving the Navy, Army, Marine Corps, Air Force, Space Force, Coast Guard, veterans, DoD & their families. Bank•Physical Branch & Digital•No Preference. - First National Bank has been serving the military since Our Ames branch is home to the U.S. Army. Military members and veterans have many options for banking, not just military-focused banks such as USAA, Armed Forces Bank or First Citizens Bank. Credit. ANB Bank is a bank like no other with the strength, talent, commitment, and security to fulfill our business and personal customers' financial needs.

Can I Apply Sunscreen Without Moisturizer

Applying sun protection after moisturiser ensures that the sunscreen can create an effective barrier without any interference from the moisturiser. This way. Apply after cleansing but before your sunscreen: If you need hydration, your moisturizer should be applied between washing your face and applying SPF. How long. Using a moisturizer before sunscreen depends on your skin type, product choice, and preference. For dry skin, using a moisturizer before. Apply liberally 15 minutes before sun exposure. Reapply at least every 2 hours. Use a water resistant sunscreen if swimming or sweating. Apply the requisite amount of 1/4 tsp to get the full SPF, and then apply your makeup on top to create the look you want for your complexion. Sun protection of. If you have oily skin, choose a lightweight and oil-free sunscreen. If you have dry skin, choose a moisturising sunscreen that will hydrate your skin. We. If you prefer to apply it after your moisturizer, make sure to wait until your moisturizer is fully absorbed first, so that the sunscreen can also be absorbed. Our data says that you probably shouldn't rely on SPF moisturiser for your main sun protection needs. It's not all doom and gloom, the moisturisers do work. The short answer is it depends. Several factors play a role: your skin type, sunscreen, and comfort during the day. I also included a little. Applying sun protection after moisturiser ensures that the sunscreen can create an effective barrier without any interference from the moisturiser. This way. Apply after cleansing but before your sunscreen: If you need hydration, your moisturizer should be applied between washing your face and applying SPF. How long. Using a moisturizer before sunscreen depends on your skin type, product choice, and preference. For dry skin, using a moisturizer before. Apply liberally 15 minutes before sun exposure. Reapply at least every 2 hours. Use a water resistant sunscreen if swimming or sweating. Apply the requisite amount of 1/4 tsp to get the full SPF, and then apply your makeup on top to create the look you want for your complexion. Sun protection of. If you have oily skin, choose a lightweight and oil-free sunscreen. If you have dry skin, choose a moisturising sunscreen that will hydrate your skin. We. If you prefer to apply it after your moisturizer, make sure to wait until your moisturizer is fully absorbed first, so that the sunscreen can also be absorbed. Our data says that you probably shouldn't rely on SPF moisturiser for your main sun protection needs. It's not all doom and gloom, the moisturisers do work. The short answer is it depends. Several factors play a role: your skin type, sunscreen, and comfort during the day. I also included a little.

(A sunscreen with a physical block like titanium dioxide or zinc oxide can be applied last, after a serum or moisturizer.) Apply a serum next and, finally. For example, a sunscreen formulated for oily skin will be lighter, and so you should use a moisturiser too otherwise your skin may not be sufficiently hydrated. That's not necessarily the case, though: if you apply too much product, you may be left with a chalky film on your skin. The rule of thumb, according to the AAD. Don't wait until you're already on the sun lounger! According to experts, you should apply chemical sunscreens around 15 minutes before you go outside into the. HOW LONG SHOULD YOU WAIT TO PUT ON SUNSCREEN AFTER MOISTURISER? To allow sunscreen to fully absorb, wait 20 minutes before sun exposure. This may seem like a. Most skincare products will not live to their potential without using at least SPF 30+ to prevent anti-ageing. However, retinol, certain exfoliants and. hyrdaruzhpnew4af.online I apply sunscreen at night instead of moisturizer? No, it's not necessary to apply sunscreen at night. Sunscreens are designed to protect the skin from. In the past we have discussed using repairing cream as a moisturizer, when it comes to whether sunscreen can be used as a moisturizer the answer is yes if the. Moisturizer and sunscreen are two essential steps in any skincare routine for healthy-looking skin. To help keep things simple, you can use a facial moisturizer. You're cheating your skin. Think about it: why use a sunscreen at night when your skin could benefit much, much more from a moisturizer that is formulated to. If moisturizer is applied before sunscreen, it will most likely create a barrier between the skin and the sunscreen, blocking the sunscreen from entering. Discover the best skin care routine for sun protection. Read on to learn whether to apply sunscreen before or after moisturizer for optimal results. Do you wear sunscreen, but still get sunburned? You might be using it incorrectly. “The biggest thing I see with patients is that they are not applying. When it comes to sun protection, the order of your skincare routine can differ. This is as long as you incorporate good skin preparation with a moisturizer and. Use this daily SPF moisturizer for healthy looking skin that's protected from the sun. Good luck and remember you can always use code MELLANK for deals all. Applying sun protection after moisturiser ensures that the sunscreen can create an effective barrier without any interference from the moisturiser. This way. If you use the recommended pea-sized amount of your moisturizer, you can apply the sunscreen 30 sec to 1 minute after your moisturizer. UV rays are well known to cause photoaging of the skin. What does this look like? The same study mentioned above also found that daily sunscreen users showed. When physical sunscreen goes on last, it can work its magic without any interference. This type of product contains minerals like zinc and titanium dioxide. It's not recommended to mix your sunscreen with your makeup or moisturizer. It may save you some time, but there is always a risk that two products won't react.

Gran Tierra Energy Stock Buy Or Sell

The consensus rating for Gran Tierra Energy is Hold while the average consensus rating for "energy" companies is Moderate Buy. Learn more on how GTE compares to. Analyst's Opinion. Consensus Rating. Gran Tierra Energy has received a consensus rating of Hold. The company's average rating score is , and is based on no. Find the latest Gran Tierra Energy Inc. (GTE) stock quote, history, news and other vital information to help you with your stock trading and investing. A Colombian energy producer. They have great cash flow. He has a target of $ per share and would buy anytime below $ Yield 0%. Stock Analysis of GTE (Gran Tierra Energy Inc.) ; QUALITY. ROA%. ROIC% ; VALUE. Price/Book Earnings Yield ; GROWTH. Asset 1-Year Growth%. At the present time, the value of relative strength index of Gran Tierra's share price is approaching This usually indicates that the stock is in nutural. Historical stock prices. Current Share Price, US$ 52 Week High, US$ 52 Week Low, US$ Beta, 11 Month Change, %. View the real-time Gran Tierra Energy Inc (GTE) stock price. Assess historical data, charts, technical analysis and contribute in the forum. Gran Tierra Energy has a current ratio of , suggesting that it has not enough short term capital to pay financial commitments when the payables are due. The consensus rating for Gran Tierra Energy is Hold while the average consensus rating for "energy" companies is Moderate Buy. Learn more on how GTE compares to. Analyst's Opinion. Consensus Rating. Gran Tierra Energy has received a consensus rating of Hold. The company's average rating score is , and is based on no. Find the latest Gran Tierra Energy Inc. (GTE) stock quote, history, news and other vital information to help you with your stock trading and investing. A Colombian energy producer. They have great cash flow. He has a target of $ per share and would buy anytime below $ Yield 0%. Stock Analysis of GTE (Gran Tierra Energy Inc.) ; QUALITY. ROA%. ROIC% ; VALUE. Price/Book Earnings Yield ; GROWTH. Asset 1-Year Growth%. At the present time, the value of relative strength index of Gran Tierra's share price is approaching This usually indicates that the stock is in nutural. Historical stock prices. Current Share Price, US$ 52 Week High, US$ 52 Week Low, US$ Beta, 11 Month Change, %. View the real-time Gran Tierra Energy Inc (GTE) stock price. Assess historical data, charts, technical analysis and contribute in the forum. Gran Tierra Energy has a current ratio of , suggesting that it has not enough short term capital to pay financial commitments when the payables are due.

Real-time Price Updates for Gran Tierra Energy Inc (GTE-T), along with buy or sell indicators, analysis, charts, historical performance, news and more. Based on analysts offering 12 month price targets for GTE in the last 3 months. The average price target is $ with a high estimate of $ and a. Stock Price Targets ; High, $ ; Median, $ ; Low, $ ; Average, $ ; Current Price, $ Gran Tierra Energy Inc's average analyst rating is Hold. Stock Target Advisor's own stock analysis of Gran Tierra Energy Inc is Neutral, which is based on 8. Investors are clearly worried about this, but today's fearful sell-off could be an opportunity to buy. Here's Why Gran Tierra Energy Inc Stock Is Jumping Today. GTE Share Price Expert Analysis, Gran Tierra Energy Inc. Buy or Sell Recommendations, Forecasts, Comparison and Market Data. The stock price for Gran Tierra Energy (AMEX: GTE) is $ last updated Today at August 7, at PM EDT. Q. Does Gran. Gran Tierra Energy Stock Buy Hold or Sell Recommendation · Stocks. USA. Considering the day investment horizon and complete risk avoidance on your part. The Barchart Technical Opinion rating is a 24% Buy with a Weakest short term outlook on maintaining the current direction. See More Share. Business Summary. buy or sell the stock. It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P Researching. Gran Tierra Energy currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the. The average one-year price target for Gran Tierra Energy Inc. is $ The forecasts range from a low of $ to a high of $ Gran Tierra Energy currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the. Is Gran Tierra Energy Stock Undervalued? The current Gran Tierra Energy [GTE] share price is $ The Score for GTE is 17, which is 66% below its historic. Overall, he says Gran Tierra "was a great play this year, but I don't think it's going to continue to be a great play heading into the remainder of this year. Ratings Values: ; Strong Buy5 ; Moderate Buy4 ; Hold3 ; Moderate Sell2 ; Strong Sell1. The stock has met the objective at after the break of the double top formation. The price has now risen again, but the formation indicates a further fall. A Colombian energy producer. They have great cash flow. He has a target of $ per share and would buy anytime below $ Yield 0%. Stock Price Targets ; High, $ ; Median, $ ; Low, $ ; Average, $ ; Current Price, $ View the real-time GTE price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees.

What To Say To Get Cheaper Car Insurance

The best way to get cheaper car insurance is to compare quotes from multiple companies and then switch to whichever insurer offers the coverage you want at the. Do a comparison 30 days before insurance is due to start and save the cheapest quote, then do another every week until the insurance is due. The. Ask for higher deductibles. Deductibles are what you pay before your insurance policy kicks in. By requesting higher deductibles, you can lower your costs. Some insurers also offer discounts for automotive features that reduce the risk of theft or personal injury. Improve your credit history: Research suggests that. 10 Ways to Get Cheaper Car Insurance · 1. Compare quotes every months. · 2. Take advantage of discounts. · 3. Increase your deductible. · 4. Improve your. quality auto coverage starts here · Choose car safety and security features. · Set higher deductibles on your auto insurance. · Take a defensive driving course. Car insurance is expensive! So here's our top 21 tips on how to save money and get cheaper car insurance, from adding yourself to the electoral register to. While these calculators don't offer exact quotes, you can get a good idea of insurance costs without providing any personal information. Top Auto Insurance. One of the best ways to save on your car insurance is to shop around and compare insurers. Even if you're happy with your current insurer, it's likely you'll. The best way to get cheaper car insurance is to compare quotes from multiple companies and then switch to whichever insurer offers the coverage you want at the. Do a comparison 30 days before insurance is due to start and save the cheapest quote, then do another every week until the insurance is due. The. Ask for higher deductibles. Deductibles are what you pay before your insurance policy kicks in. By requesting higher deductibles, you can lower your costs. Some insurers also offer discounts for automotive features that reduce the risk of theft or personal injury. Improve your credit history: Research suggests that. 10 Ways to Get Cheaper Car Insurance · 1. Compare quotes every months. · 2. Take advantage of discounts. · 3. Increase your deductible. · 4. Improve your. quality auto coverage starts here · Choose car safety and security features. · Set higher deductibles on your auto insurance. · Take a defensive driving course. Car insurance is expensive! So here's our top 21 tips on how to save money and get cheaper car insurance, from adding yourself to the electoral register to. While these calculators don't offer exact quotes, you can get a good idea of insurance costs without providing any personal information. Top Auto Insurance. One of the best ways to save on your car insurance is to shop around and compare insurers. Even if you're happy with your current insurer, it's likely you'll.

Need help figuring out how many of our car insurance discounts apply to you? We're here to help. Just get an online car insurance quote to see the savings. Or. Since there is no standard discount and no legal requirements, you will need to contact your insurance provider to learn about their car insurance discount. 1. Shop around · 2. Before you buy a car, compare insurance costs · 3. Ask for higher deductibles · 4. Reduce coverage on older cars · 5. Buy your homeowners and. How to Save on Car Insurance · 1. Take Advantage of Multi-car Discounts · 2. Pay Attention on the Road · 3. Take a Defensive Driving Course · 4. Shop Around for. 7 ways to lower your car insurance premium · Qualify for insurance discounts · Increase your deductible · Reduce your coverage · Compare rates · Try usage-based. Getting low-cost auto insurance can be as simple as earning discounts, driving responsibly, or customizing your policy to find a balance between costs and. Try all cover types; Black box insurance without the black box; Clear your cache; Plan in advance; Don't set your mileage too low; Additional drivers; Use. How to Lower Your Car Insurance Rate · Combine auto and home policies: · Review your limits and deductibles: · Update your policy information regularly: · Pay for. There's no reason to call a few insurance companies during work hours and answer the same list of questions. Instead, get several car insurance quotes at once. These factors may include things such as your age and your driving record. While it may be tempting to reduce or eliminate coverages to help lower your car. Research what discounts are offered by your insurance company to make sure you're getting the best price on your car insurance. get lower insurance rates. How to get cheap car insurance: discounts and tips · Remember: your car insurance rate is specific to you · Auto insurance discounts · Multi-policy/bundling auto. You'll always get the best insurance rate by paying as much of your premium up front as possible. Six months is usually the maximum. Smart Driver Rule: If you. If you're able, choosing higher car insurance deductibles will reduce your monthly payments. However, if you are involved in an at-fault car accident down the. Determine the auto insurance you really need. · Take care of your driving record. · Consolidate your auto insurance policies. · Drive the least expensive vehicle. You may reduce your auto insurance costs by raising the deductibles on physical damage (collision and comprehensive) coverages or by eliminating these. Install Safety and Security Devices · Dig for Discounts · Combine and Consolidate Policies · Opt for a Higher Deductible. Other ways to make your car insurance cheaper · Bundle and Save. Save up to 10% when you bundle auto and property policies. · Multi-Vehicle Discount. You'll save. Car insurance discounts Because every policy is different, the exact savings you get from bundling your home and auto insurance policies is unique to you. Peachstate Insurance provides competitive auto, commercial auto, recreational vehicle and more insurance services and more in Atlanta, Georgia.