hyrdaruzhpnew4af.online

Prices

Where Can I Cash Any Check

You have a variety of alternatives at your disposal. These include check-cashing services like RiteCheck, retail locations, and mobile apps. How Check Cashing Works ; Find a Store. Visit a store nearby to use our easy check cashing services. ; Bring Your ID. Bring your check, along with a Government-. A few options: Walmart cashes personal checks under (there is a fee). Cashapp /Venmo/Walmart money card has option to do mobile deposit. Fee TypeCheck Cashing · DescriptionFee to cash a check in an ESL branch, if you do not have an ESL account. · FeeCheck up to $1, $ per check. Check from. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. Get your check cashed today! Get your cash and some snacks inside your favorite retailer. SAM Check Cashing Kiosks are conveniently located inside retail. Need to cash a check but don't have a bank account? Even if it's handwritten or out of state, you can get cash immediately with check cashing service. Enroll online or in branches · Cash checks from any bank, not just Regions, without a Regions checking account · Cash checks at all Regions branches. Learn about the options available regarding cashing a check without a bank account or ID. You have a variety of alternatives at your disposal. These include check-cashing services like RiteCheck, retail locations, and mobile apps. How Check Cashing Works ; Find a Store. Visit a store nearby to use our easy check cashing services. ; Bring Your ID. Bring your check, along with a Government-. A few options: Walmart cashes personal checks under (there is a fee). Cashapp /Venmo/Walmart money card has option to do mobile deposit. Fee TypeCheck Cashing · DescriptionFee to cash a check in an ESL branch, if you do not have an ESL account. · FeeCheck up to $1, $ per check. Check from. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. Get your check cashed today! Get your cash and some snacks inside your favorite retailer. SAM Check Cashing Kiosks are conveniently located inside retail. Need to cash a check but don't have a bank account? Even if it's handwritten or out of state, you can get cash immediately with check cashing service. Enroll online or in branches · Cash checks from any bank, not just Regions, without a Regions checking account · Cash checks at all Regions branches. Learn about the options available regarding cashing a check without a bank account or ID.

How do I cash a check using PayPal? · Go to your Accounts · Choose Cash a Check · Enter the check amount, take a picture of the front and back of your endorsed. With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes. You can cash a check at Walmart in most states for a minimal fee. If you have a smartphone, you can also cash a check through Paypal, with funds available. Come in and cash in. Cash your tax refund checks at your nearest CFSC locations. It's possible to cash a check without a bank account by cashing it at the issuing bank or a check cashing store. It's also possible to cash a check if you've. You can cash a check without a bank account at check-cashing businesses, like Payomatic, PLS 24/7, Speedy Cash, CSFC or at stores like Walmart or Kroger. You. Regions offers check cashing services — including handwritten, out-of-state, insurance, two-party, tax refunds, business, government and payroll. We're happy to cash any check amount. Keep in mind that large checks for more than $20, may take a little extra time to be verified. What do I need to. Get your check cashed today! Get your cash and some snacks inside your favorite retailer. SAM Check Cashing Kiosks are conveniently located inside retail. 1. Payomatic. (3 reviews). Check Cashing/Pay-day Loans · 2. PLS checking Cashing. (7 reviews) · 3. CFSC Checks Cashed. (8 reviews) · 4. United Check. Types of checks we can cash. For people without a KeyBank deposit relationship, we can quickly and securely cash checks drawn on KeyBank accounts, as long as. There are several ways to cash a check if you don't have a bank account. Some of these alternatives may come with fees or extra legwork. Check Cashing at Check City is a convenient place to cash many types of checks and use a variety of check cashing services. Find a location near you. Your options include reputable check-cashing stores, department and grocery stores that provide check-cashing services, and smaller retail stores. There are several ways to cash a check if you don't have a bank account. Some of these alternatives may come with fees or extra legwork. LendNation has more than + locations across 12 states ready to help serve your money needs – whatever they may be. Stop by and walk out with cash today. If you want to cash a check for free, then your bank or credit union is your best option. Account holders can cash checks for free at banks. As long as it is the same corporation, they will cash the check, IF YOU HAVE ID TO PROVE YOU ARE THE LEGAL OWNER. In the mean time, take a deep. The only place where you can cash a check for free is at a traditional bank or credit union where you have an account in good standing, and the bank or credit.

Rollover 401k To Roth Ira Tax Rate

When you roll over a retirement plan distribution, you generally don't pay tax on it until you withdraw it from the new plan. By rolling over, you're saving for. For an investor in a lower tax bracket, traditional IRA contributions may be tax-deductible while Roth IRA contributions are not. After conversion, in order to. Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. converting it to a Roth. If you were to do this conversion in normal working years, that taxable amount is added to your top tax bracket and maybe would push you into. You cannot postpone taxation of taxable (pre-tax) amounts rolled over into a Roth IRA even if you roll it over into a Roth IRA within 60 days. • If you want to. A rollover of a Qualified Distribution from a previous Roth IRA to the Roth NYCE IRA would be treated as tax-free. Rollover from Roth (k) to the Roth NYCE. If you choose to convert a traditional IRA to a Roth IRA, timing matters. You'll have to pay taxes on the amount you convert at your regular income tax rate. Converting a traditional IRA to a Roth IRA lets you transfer all or a portion of your traditional accounts into a Roth IRA. But it comes with a tax bill. If you own a traditional IRA or other non-Roth IRA, or have an old workplace retirement plan such as a (k), (b), or (b), you can pay taxes on your. When you roll over a retirement plan distribution, you generally don't pay tax on it until you withdraw it from the new plan. By rolling over, you're saving for. For an investor in a lower tax bracket, traditional IRA contributions may be tax-deductible while Roth IRA contributions are not. After conversion, in order to. Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. converting it to a Roth. If you were to do this conversion in normal working years, that taxable amount is added to your top tax bracket and maybe would push you into. You cannot postpone taxation of taxable (pre-tax) amounts rolled over into a Roth IRA even if you roll it over into a Roth IRA within 60 days. • If you want to. A rollover of a Qualified Distribution from a previous Roth IRA to the Roth NYCE IRA would be treated as tax-free. Rollover from Roth (k) to the Roth NYCE. If you choose to convert a traditional IRA to a Roth IRA, timing matters. You'll have to pay taxes on the amount you convert at your regular income tax rate. Converting a traditional IRA to a Roth IRA lets you transfer all or a portion of your traditional accounts into a Roth IRA. But it comes with a tax bill. If you own a traditional IRA or other non-Roth IRA, or have an old workplace retirement plan such as a (k), (b), or (b), you can pay taxes on your.

A: If you withdrew Roth assets within five years of the conversion you would owe a 10% federal penalty tax on the portion of the withdrawal attributable to the. For more information see IRS Publication ,. Pension and Annuity Income. If you roll over your payment to a Roth IRA. If you roll over a payment from TRS to a. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would. The taxes will be calculated based on your marginal income tax bracket and the amount of money you convert from your traditional IRA or employer plan assets. If. You can roll over the original contribution amounts to a Roth IRA without paying taxes, as long as certain rules are met. If you are not converting all of your IRAs or the entire amount in your employer-sponsored plan, you must convert a prorated amount of the pre-tax (deductible). What types of retirement accounts and plans may accept my rollover? You may roll over the payment to either an IRA (an individual retirement account or. Money withdrawn will be taxable and subject to a mandatory 20% federal withholding rate. You may also face early withdrawal penalties. Pros. You cannot postpone taxation of taxable (pre-tax) amounts rolled over into a Roth IRA even if you roll it over into a Roth IRA within 60 days. • If you want to. Qualified withdrawals from Roth accounts are tax-free and won't increase your taxable income. Do you think that all income tax rates will be higher in the. The best scenario for a Roth conversion is when a person has cash on hand or other non-retirement assets available to pay the tax that is due or has tax losses. Consider the costs of a conversion: how you would pay for it, the % net investment income tax, and gains on company stock in a (k). Consider whether or. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. The taxes will be calculated based on your marginal income tax bracket and the amount of money you convert from your traditional IRA or employer plan assets. If. When determining the optimal amount of IRA assets to convert to a Roth IRA, we typically target an amount that would “fill up” a specific tax bracket. For. If you convert traditional (k) or IRA assets to a Roth, you'll owe taxes on the converted amount. But you won't owe any taxes on qualified withdrawals in. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You. The money will be taxed at your ordinary income rate, depending on what tax bracket you're in. For the 20tax years, the income tax brackets range. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would.

1 Acr

ACR-1 Compression Device. $ ACR-1 Compression Device quantity - + Add to cart. Description • ACR-1 Compression Device. ACRGS-S1-M-1 Samtec Specialized Cables AccliMate IP68 Sealed Circular Panel Assembly, Receptacle, 12 mm Shell datasheet, inventory, & pricing. /8" OD Copper Tube, Type ACR, 12' Length, 1" Inside Diameter, Hard, Straight, PSIG Operating Pressure. Log in to your account. Welcome to ACR's 1ACR Portal also known as the web portal for customer purchase order and sales information. Shop Boeing for , ACR Rescue Light Test Set, For Model L(A), L, L Test Set. Boeing offers Aircraft Parts, Chemicals, Tools, and more. The new ACR GlobalFix V5 EPIRB combines MHz satellite connectivity with Automatic Identification System (AIS) functionality. Description. Headset compression device for ACR steerer tubes. ; Type, Star nut and compression device ; Technology, ABS ; Discipline, ROAD, MTB. Innovative, quick-change hydrostatic release mechanism · One-way mounting eliminates the possibility of installing EPIRB backward · Integral de-activation magnet. One Acre Fund supplies farmers with the farm supplies and training they need to grow more food and earn more money. ACR-1 Compression Device. $ ACR-1 Compression Device quantity - + Add to cart. Description • ACR-1 Compression Device. ACRGS-S1-M-1 Samtec Specialized Cables AccliMate IP68 Sealed Circular Panel Assembly, Receptacle, 12 mm Shell datasheet, inventory, & pricing. /8" OD Copper Tube, Type ACR, 12' Length, 1" Inside Diameter, Hard, Straight, PSIG Operating Pressure. Log in to your account. Welcome to ACR's 1ACR Portal also known as the web portal for customer purchase order and sales information. Shop Boeing for , ACR Rescue Light Test Set, For Model L(A), L, L Test Set. Boeing offers Aircraft Parts, Chemicals, Tools, and more. The new ACR GlobalFix V5 EPIRB combines MHz satellite connectivity with Automatic Identification System (AIS) functionality. Description. Headset compression device for ACR steerer tubes. ; Type, Star nut and compression device ; Technology, ABS ; Discipline, ROAD, MTB. Innovative, quick-change hydrostatic release mechanism · One-way mounting eliminates the possibility of installing EPIRB backward · Integral de-activation magnet. One Acre Fund supplies farmers with the farm supplies and training they need to grow more food and earn more money.

Stanpro (Standard Products Inc.) PARACUBE 1 ACR SLV 2x4 FLG (). $

1) Negative screen: does not mean that an individual does not have lung *Additional resources available at - hyrdaruzhpnew4af.online C The Artex C is an emergency locator transmitter (ELT) that has been built to meet the rigorous requirements of TSO C, and pass even the toughest. 1/0 AWG. Stud Material, Tinned Copper. Terminal Ring Diameter Clearance A: One ACR will manage the charge between two battery banks. Three battery. In DISCOVER 1: Week 24 (primary endpoint): 52% of patients receiving TREMFYA ® q8w (66/) achieved an ACR20 response vs 22% of patients receiving placebo. TYPE L - ACR/OXY/MED Hard 20 FT Lengths is Cleaned And Capped/Degreased to ensure tube reaches customer in a pure, defect-free state. "ID x /8"OD x 20 ft Type ACR - Hard Copper Tubing. Tubing. Fastenal Sku: Online Price: $ / each. -. +. ADD TO CART. Availability. This ACR MRI Phantom Kit includes the following: 1 ACR MRI Phantom 1 ACR Phanotm Case 1 ACR Phantom Refill Kit The ACR MRI Phantom is an 8" ( mm). Great Lakes /8" OD X 1" ID X 12' ACR Copper Tube/8" OD Copper Tube, Type ACR, 12' Length, 1" Inside Diameter, Hard, Straight, PSIG Operating. 1 - 7 of 7 Items. COPPER TUBING /8" X 20' ACR. COPPER TUBING COPPER TUBING /8" X 20' ACR. Log In for Pricing and Availability. ACR Copper Tubing, 1/2". ACR Copper Fittings · 1/2 90 C OD ACR Copper ACR 1/2" Long Radius 90 · 1/2 CPLG C OD ACR Copper ACR 1/2" OD Coupling CxC · 1/2 ST90 C OD ACR. The ACR Appropriateness Criteria (AC) are evidence-based guidelines to assist referring physicians and other providers in making the most appropriate imaging. Hard Copper Type ACR Water Tube, /8 IN X 20 FT. ACR, ACR, /4, 1/4 hex. ACR10 - Copper tubing, ACR, /8" OD, 10 Ft long, priced by foot. Buy ICS Industries - 1/4" OD Copper Refrigeration ACR Tubing FT: Tubes - hyrdaruzhpnew4af.online ✓ FREE DELIVERY possible on eligible purchases. PN: Torq-Set® ACR® Insert Bit Removal of Torq-Set® fasteners can require up to three times the torque of installation due to corrosion and shear. ACR Open Rheumatology is the official open access rheumatology journal of the Pages: January Sign up for email alerts. Enter your email to. About this item · Good quality copper tubing for Refrigeration. · ASTM B · Type Refrigeration ACR Soft Copper Tube (1/4" OD) Wall · MADE IN USA. ACR copper fittings are rugged and highly resistant to corrosion. They are used as refrigerant lines in HVAC systems, and to supply hot and cold water. Their.

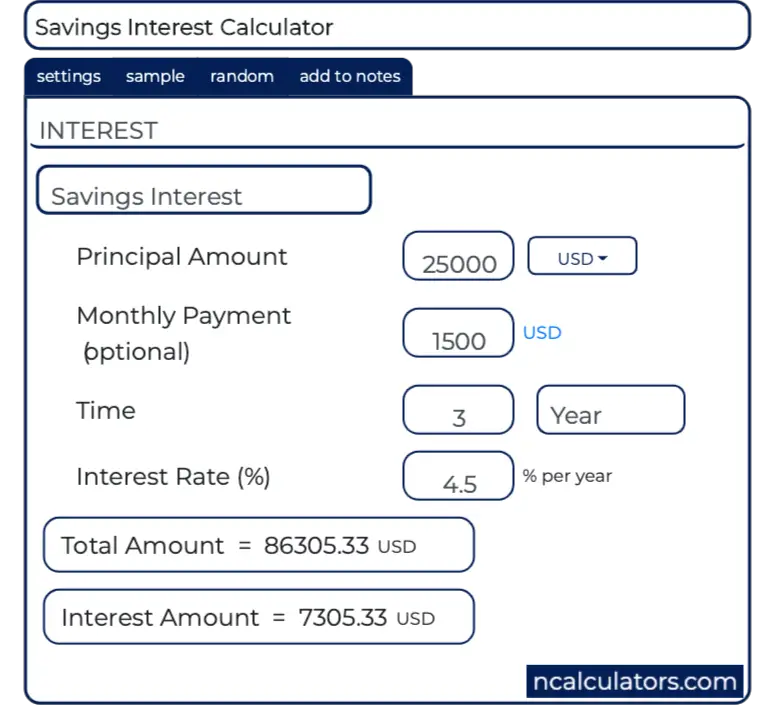

Regular Savings Account Interest Calculator

Our savings account calculator will help you see how much interest your savings account is earning—or if it's time to change banks to earn more. Use this calculator to see how different savings rates can impact your savings strategy! Whether it's a High-Yield Savings account, Money Market, or standard. The Regular Savings Calculator allows you to compute the initial deposit, the regular deposit, the maturity or the final amount including interest on the basis. From high-interest savings options to convenient personal accounts, Patelco A regular savings account for all your savings goals. Required for. Monthly contribution. Will you add to your savings every month? If so, that's your monthly contribution. It can be helpful to automate this and have your bank. savings account with higher variable interest rates The Regular Savings Calculator gives indicative results for the total accumulation in a savings account. Use this free savings calculator to understand how your money can grow over time. When you put money in a savings account, the interest you earn builds on. interest rates are normally quite low. Check out Bankrate for a useful comparison of the best savings account rates. Stock Market Investments: If you're. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions. Our savings account calculator will help you see how much interest your savings account is earning—or if it's time to change banks to earn more. Use this calculator to see how different savings rates can impact your savings strategy! Whether it's a High-Yield Savings account, Money Market, or standard. The Regular Savings Calculator allows you to compute the initial deposit, the regular deposit, the maturity or the final amount including interest on the basis. From high-interest savings options to convenient personal accounts, Patelco A regular savings account for all your savings goals. Required for. Monthly contribution. Will you add to your savings every month? If so, that's your monthly contribution. It can be helpful to automate this and have your bank. savings account with higher variable interest rates The Regular Savings Calculator gives indicative results for the total accumulation in a savings account. Use this free savings calculator to understand how your money can grow over time. When you put money in a savings account, the interest you earn builds on. interest rates are normally quite low. Check out Bankrate for a useful comparison of the best savings account rates. Stock Market Investments: If you're. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions.

Try our savings interest calculator to see how much interest you could be earning with a Marcus Online Savings Account vs. other banks. Use our Interest Calculator to develop a savings plan. How much is your initial deposit? Additional contributions Monthly Annually How many years do you plan. A savings account interest rate calculator is a quick-and-easy tool that helps you figure out the interest you can earn monthly on your savings account balance. Savings Calculator. Chart your savings account as it goes up, up, up. Use this tool to see how your interest rate pays off in the long term — and how smart. Use this calculator to estimate how much interest you'll earn on regular savings accounts, certificates of deposit and more! Monthly savings contribution; Years to save; Estimated interest rate; Savings goal. Our savings calculator is for simple interest accounts and can help you. However, most savings accounts calculate and pay interest monthly instead of annually. So, how do you find your monthly interest rate? It's easy. Simply divide. Calculate interest growth on all your savings accounts You may opt for a regular savings account, a CD, an IRA, or one of the many other savings. You can calculate the monthly savings interest rate by multiplying the principal or initial balance by the interest, and then multiply again by the time of one. rate you'd get from a regular savings account. CDs can also be beneficial Interest can be calculated daily, monthly or quarterly. The more. Enter the sum you will save on a monthly basis. Enter the interest rate earned on the account. How much do you want to save each month. Calculate your savings growth with ease using our Compound Interest Calculator. For instance, if you wanted to calculate monthly interest taken on a monthly loan, investment, or your regular savings account. For a quick example. Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month. Regular Savings Accounts. Boost the savings rate you get by saving monthly ; How to Start Saving. Maximise the interest you get ; Top Savings Accounts. Pick from. Interest rates vary greatly depending on the type of account, supply and demand, and what the Federal Reserve sets. For a typical savings account, you could. Let's go back to the savings account example above and use the daily compound interest calculator to see the impact of regular contributions. We started with. Interest is calculated using the compound interest formula on the starting balance and factors in any regular monthly deposit. The calculator assumes no. The calculation is based on the account's interest rate and the frequency with which that interest is compounded (e.g., daily or monthly). A savings account. Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month.

Income Eligibility For Roth Ira

Want to open and contribute to a Roth IRA? Learn the Roth IRA contribution limits for , and Roth IRA income limits here. If you have a Roth IRA, there are income limits that can limit your contribution. Always check the latest IRS guidelines to ensure your IRA remains in. There are no income limits for a traditional IRA, but how much you earn has a direct bearing on how much you can contribute to a Roth IRA. Your Modified Adjusted Gross Income (MAGIOpens Dialog) determines your eligibility to contribute. · Contributions to a Roth IRA are not tax-deductible, so there. While income limits may prevent you from contributing to a Roth IRA, the UC (b) and (b) Plans don't carry these income limits. So if you're not eligible. Roth IRA age requirements. There are no restrictions on age for contributing to a Roth IRA. As long as you have some income and do not exceed the MAGI limits. Taxpayers who are married and filing jointly must have incomes of $73, or less. ($76, or less in ) · All head of household filers must have incomes of. The contribution limits for Roth IRAs · For , $6,, or $7, if you're age 50 or older by the end of the year; or your taxable compensation for the year. To be eligible to contribute the maximum amount in , your modified adjusted gross income (MAGI) must be less than $, (up from $, last year) if. Want to open and contribute to a Roth IRA? Learn the Roth IRA contribution limits for , and Roth IRA income limits here. If you have a Roth IRA, there are income limits that can limit your contribution. Always check the latest IRS guidelines to ensure your IRA remains in. There are no income limits for a traditional IRA, but how much you earn has a direct bearing on how much you can contribute to a Roth IRA. Your Modified Adjusted Gross Income (MAGIOpens Dialog) determines your eligibility to contribute. · Contributions to a Roth IRA are not tax-deductible, so there. While income limits may prevent you from contributing to a Roth IRA, the UC (b) and (b) Plans don't carry these income limits. So if you're not eligible. Roth IRA age requirements. There are no restrictions on age for contributing to a Roth IRA. As long as you have some income and do not exceed the MAGI limits. Taxpayers who are married and filing jointly must have incomes of $73, or less. ($76, or less in ) · All head of household filers must have incomes of. The contribution limits for Roth IRAs · For , $6,, or $7, if you're age 50 or older by the end of the year; or your taxable compensation for the year. To be eligible to contribute the maximum amount in , your modified adjusted gross income (MAGI) must be less than $, (up from $, last year) if.

Roth IRA Rules: Income and Contribution Limits · $ if your income is low enough (and $ if you're 50 or older) for · $ more than that for Your modified adjusted gross income (MAGI) determines whether you are eligible to make a contribution to a Roth IRA at all. · The following are the MAGI limits. Roth IRA income limits. ; Single · Head of household · Married filing separately (if you didn't live with your spouse in ) · $, or more, Not eligible. Your distribution is income tax-free if you are eligible for a distribution Contribution limits – Roth IRA contributions are limited to. $7, in For , the total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than: $7, ($8, if you're age 50 or older. Yes. It is up to the employee to determine if you meet the applicable income limits to contribute to a Roth IRA account. Simply put, if you make over a. Check with your tax advisor to see if your income would affect your eligibility to contribute to a Roth IRA. To learn more, refer to the Annual Limits Guide . If you file taxes as a single person, your modified adjusted gross income (MAGI) must be under $,0to contribute the full amount. At higher income. Generally, a traditional IRA has no income limit affecting pre-tax contributions, unless you (or your spouse) have a workplace retirement plan, such as a (k). Those that meet the Roth IRA income limits can make the max Roth IRA contribution, which is reviewed and adjusted annually. Currently, Roth contribution limits. Contributions are made with after-tax dollars. You can contribute to a Roth IRA if your Adjusted Gross Income (AGI) is: Less than $, (single filer) The IRS limits contributions to a Roth IRA based on set income limits to enforce fairness. Fairness how? Whether you make 60k or k you are. The combined annual contribution limit for Roth and traditional IRAs for the tax year is $7,, or $8, if you're age 50 or older. · That is a combined. Roth IRA - Am I Eligible?Collapse · Partially deductible for MAGI up to $10, · No deduction for MAGI more than $10, There are no income limits for converting Traditional IRA assets to a Roth IRA. · For married taxpayers filing separately: If you did not live with your spouse. If you are single, your income must be less than $95, (MAGI - modified adjusted gross income) in order to be eligible to fund the $3, maximum amount. If you're age 50 or older, you can contribute up to $8, Limits could be lower based on your income. Get details on IRA contribution limits & deadlines. If your modified adjusted gross income (MAGI) is more than $, for married joint filers or $, for single filers, you cannot make a Roth contribution. If you and your spouse file separate returns, the income limit (phase-out range) is $0 to $10, So, you can't claim the IRA deduction if your MAGI is more. Earnings and profits from property, such as rental income, interest income, and dividend income · Pension or annuity income · Deferred compensation received .

30 000 Loan Over 10 Years

loan length and APR. Rate, 30 Year Loan, 25 Year Loan, 20 Year Loan, 15 Year Loan, 10 Year Loan, 5 Year Loan, 3 Year Loan. %, , , , What are the standard interest rates for personal loans? ; 5 year auto loan with bad credit, $0, 14% to 16% ; year mortgage, 2% to 5%, % ; year mortgage. LendingTree's personal loan calculator can help you see how much your loan could cost, including principal and interest. Loans from €5, - €75, and repay over terms from 1 to 10 years. Fully Online Application. Applying for your loan is a quick and simple process. Quick. Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans. Use our calculator here today. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. 30 Year fixed rate amortization loan table: at 7 percent interest. ; 7, $29,, ; 8, $29,, ; 9, $29,, ; 10, $29, A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate. loan length and APR. Rate, 30 Year Loan, 25 Year Loan, 20 Year Loan, 15 Year Loan, 10 Year Loan, 5 Year Loan, 3 Year Loan. %, , , , What are the standard interest rates for personal loans? ; 5 year auto loan with bad credit, $0, 14% to 16% ; year mortgage, 2% to 5%, % ; year mortgage. LendingTree's personal loan calculator can help you see how much your loan could cost, including principal and interest. Loans from €5, - €75, and repay over terms from 1 to 10 years. Fully Online Application. Applying for your loan is a quick and simple process. Quick. Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans. Use our calculator here today. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. 30 Year fixed rate amortization loan table: at 7 percent interest. ; 7, $29,, ; 8, $29,, ; 9, $29,, ; 10, $29, A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate.

The monthly payment of a loan at % is Percentage of Income Spent, Monthly Income Required. 15%, 2, %, 1, 20%, 1, 7 years, $ $10,, 10%, 10 years, $ $10,, 10%, 15 years, $ Notice that The chart below illustrates monthly payments for a $5, loan over a. %. Loan inputs: Press spacebar to hide inputs, [-]. Calculate: Payment. Amount. Loan amount: $. $0. $k. $1m. $10m. Monthly payment: $. $0. $1k. $10k. $k. The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Interest rate. Annual fixed interest rate for. Mortgage Loan of $30, for 10 years at percent interest. Monthly Payments Calculator. We offer unsecured personal loans. This means that if we decide to lend you money, it won't be secured on your home, car or other assets. · Available repayment. How Much Will My Monthly Mortgage Payments Be? This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates. Last year, students were 4X more likely to be approved with a cosigner9 years based on cumulative Sallie Mae loan balance, repayment option. Calculate your next loan! Information and interactive calculators are made available to you as self-help tools for your independent use. But if you take out a $6, loan for seven years with an APR of 4%, your monthly payment will be $ Almost all personal loans offer payoff periods show. Amortization schedule. Year $0 $5K $10K $15K $20K $25K 0 1 2 3 4 5 Balance over the life of a personal loan. Since most personal loans come with. loans are offered by banks, credit unions, and online lenders. These loans can help you cover a large purchase or unexpected expense. Learn more. loan term (length of loan) anywhere from 10 years all the way to 30 years. Most prospective borrowers choose either a year mortgage or a year mortgage. With these loans, you receive a lump sum and pay it off with a fixed interest rate for five to twenty years. Home Equity Line of Credit (HELOC). Unlike a home. Private student loans generally come with terms of 10 years to 25 years. Mortgages tend to have , or year terms. A longer loan term may mean smaller. At least 10% of the applicants approved for these terms qualified for the lowest rate available based on data from 04/01/ to 06/30/ The rates shown are. Use our monthly payment calculator to determine your total monthly payment on all your fixed term loans and lines of credit. year mortgage calculator: Weigh the pros and cons of these two common mortgage terms. Refinance calculator: See if you could save money by refinancing your. You might think you can calculate your total borrowing costs for the year by multiplying your loan amount by your APR, but because most personal loans are. For example, if you know how much you can afford for a monthly payment over a certain number of months and you want to calculate how much money you might afford.

Apps To Spy On People

App Store Preview. Open the Mac App Store to buy and download apps. Spy 4+. A game for 3+ people. Matvey Kavtorov. Designed for iPad. # in Family. • K. Spyic is a user-friendly spy app for iPhones that helps individuals keep an eye on children by tracking their phone devices. It is one of the top spy apps for. mSpy is an app built around the idea that knowing is always better than hoping. Loaded with features, it gives you a clear picture of the user's digital world. If you are looking for a spy phone app free you can download AnyControl and install it on your target device to view all the activties and reports remotely and. Finding Hidden Spy Apps on Android To find apps that might be hidden from your installed apps list, go to your files app and click on downloads. If you see. Here are 5 spy apps that you should know about #spyapps #androidspyapp #phonesecuritytips #iphonesecurity #security #. Later on when we got divorced I got to know that he had installed a spy app (by the name of xnspy) on my phone which i was able to remove after. Searqle is a free spy app that allows users to monitor someone's phone activities remotely. With Searqle, users can track text messages, call. Like most spy apps, Eyezy provides a real-time cell phone tracker to enable you to monitor your child's or partner's movements. This feature allows you to see. App Store Preview. Open the Mac App Store to buy and download apps. Spy 4+. A game for 3+ people. Matvey Kavtorov. Designed for iPad. # in Family. • K. Spyic is a user-friendly spy app for iPhones that helps individuals keep an eye on children by tracking their phone devices. It is one of the top spy apps for. mSpy is an app built around the idea that knowing is always better than hoping. Loaded with features, it gives you a clear picture of the user's digital world. If you are looking for a spy phone app free you can download AnyControl and install it on your target device to view all the activties and reports remotely and. Finding Hidden Spy Apps on Android To find apps that might be hidden from your installed apps list, go to your files app and click on downloads. If you see. Here are 5 spy apps that you should know about #spyapps #androidspyapp #phonesecuritytips #iphonesecurity #security #. Later on when we got divorced I got to know that he had installed a spy app (by the name of xnspy) on my phone which i was able to remove after. Searqle is a free spy app that allows users to monitor someone's phone activities remotely. With Searqle, users can track text messages, call. Like most spy apps, Eyezy provides a real-time cell phone tracker to enable you to monitor your child's or partner's movements. This feature allows you to see.

Another form of spyware is 'stalkerware', which involves someone you know installing a spying app on your device without your permission or knowledge. These. people track your location for safety reasons, but some apps may be doing it without your knowledge. App spy on you even when you sleep. If you're an iPhone. These apps are designed to not stand out on a device, and many are also marketed as undetectable – unnoticeable. They will sometimes also appear in the app list. If you're worried that someone has installed a hidden spy app on your Android device, You can use AirDroid Parental Control to check. Open it and tap on App. Phone spy lets you see texts, photos, calls, website history, GPS & more. Compatible with Android, iOS, PC and Mac. Spyera is another great spy tracking app that offers a wide range of features, such as the ability to remotely access your device's camera and microphone, track. Free cell phone spy app is the best invisible software for Android mobiles that secretly tracks calls, spy camera, WhatsApp, Facebook, Viber, SMS. PanSpy is one of the best apps to spy on text messages designed to check another person's smartphone activity. It can monitor someone else's texts and social. How to check your phone for spying apps? · Go to your Android smartphone settings · Click on “Apps” (or “Applications) · Click the three vertical dots on the top. Here's how you can check to see if someone may be spying on your phone, whether it's location, using the camera, or spying on your calls. Spapp Monitoring is the most advanced tracking app for Android. Spapp Monitoring records all phone calls, SMS, GPS coordinates, Whatsapp calls or messages. Stalkerware can allow someone to turn on the webcam or microphone, take screenshots, see activity on third-party apps (such as Snapchat or WhatsApp), and. Hidden Apps Detector will scan of your apps and detect hidden app install in your smartphone. Hidden Apps detector is free android app to detect hidden apps. SpyBubblePro is a monitoring software designed to operate stealthily on smartphones. It caters to individuals who wish to observe the activities. Quick summary of the best spy apps with a free trial · 1. Qustodio — Best Spy App With a Free Trial in · 2. Norton Family — Best Spy App With the Longest. Stalkerware can allow someone to turn on the webcam or microphone, take screenshots, see activity on third-party apps (such as Snapchat or WhatsApp), and. spy apps that you can download and use right now. These apps will allow you to unlock your smartphones full spying potential. Enjoy. SpyBubble is a very easy spying app to use and is an even easier spying application to install on the device you want to monitor. It is a cloud-based. If you notice any strange data usage spikes, it may be a sign of spy apps. If someone is spying on your cell phone, they're using the network to download the. Overall, Mspy is a powerful spy app that offers a range of features that can be useful for parents, employers, and individuals who want to.

Can Life Insurance Proceeds Be Rolled Into An Ira

:max_bytes(150000):strip_icc()/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

Spouses can roll over inherited (k) assets into an inherited IRA. The IRS waives any early withdrawal penalties for owners of inherited IRAs so they can. Can I deposit money into my TCA? No. Funds for your TCA can only come from a life insurance claim or annuity closeout. When you withdraw money from your TCA. Taxes on death benefits vary depending on the source of the money, with life insurance proceeds typically being tax-free. funds into an existing IRA and be. Life insurance proceeds are generally not taxable. If you inherit an IRA and you are the sole beneficiary spouse of the account owner, you have more choices in. Death Gratuity / Servicemembers' Group Life Insurance (SGLI) Bottom line – you can put SGLI and death gratuity payments into tax-advantaged accounts. The designated Beneficiary is the Grantor's surviving spouse, the remaining interest will be distributed over the surviving spouse's life expectancy as. You also could complete an indirect IRA-to-IRA rollover, where you take a distribution from the inherited assets and then roll those assets into your own. Q: I received an IRA distribution and then rolled some (or all) of the funds into another IRA. Q: Can I transfer ownership of my life insurance to someone. You can't buy life insurance within an IRA. You also can't contribute an insurance policy to an IRA or roll a policy from an employer plan into an IRA. About. Spouses can roll over inherited (k) assets into an inherited IRA. The IRS waives any early withdrawal penalties for owners of inherited IRAs so they can. Can I deposit money into my TCA? No. Funds for your TCA can only come from a life insurance claim or annuity closeout. When you withdraw money from your TCA. Taxes on death benefits vary depending on the source of the money, with life insurance proceeds typically being tax-free. funds into an existing IRA and be. Life insurance proceeds are generally not taxable. If you inherit an IRA and you are the sole beneficiary spouse of the account owner, you have more choices in. Death Gratuity / Servicemembers' Group Life Insurance (SGLI) Bottom line – you can put SGLI and death gratuity payments into tax-advantaged accounts. The designated Beneficiary is the Grantor's surviving spouse, the remaining interest will be distributed over the surviving spouse's life expectancy as. You also could complete an indirect IRA-to-IRA rollover, where you take a distribution from the inherited assets and then roll those assets into your own. Q: I received an IRA distribution and then rolled some (or all) of the funds into another IRA. Q: Can I transfer ownership of my life insurance to someone. You can't buy life insurance within an IRA. You also can't contribute an insurance policy to an IRA or roll a policy from an employer plan into an IRA. About.

If the policy is surrendered without a Exchange, the gain from the original life insurance contract will be taxed as ordinary income (not capital gains). If your heirs differ in age or ability to manage money, a predetermined beneficiary payout option can restrict access to funds for some of them, while allowing. If you own a life insurance policy, the R could be the result of a taxable event, such as a full surrender, partial withdrawal, loan or dividend. the court order must be resolved before any death benefit payments can be Also, the death benefit payment cannot be rolled over into any type of. IRA. Gross income does not include that part of any amount received as an annuity under an annuity, endowment, or life insurance contract which bears the same ratio. A qualified annuity includes an IRA or an annuity bought with the proceeds from a traditional IRA (rollover), a simplified retirement account, an employee. Spouse beneficiaries can roll the funds into an existing IRA account or open a new account. insurance products but may refer you to an affiliated or third. A life insurance policy provides benefits to your family if you die. An It is likely you will also be subject to a new surrender period before you can. (c) No part of the Deemed IRA Trust funds will be invested in life insurance contracts. Rollovers – Assets can be rolled into the NYCE IRA from. Generally, life insurance proceeds paid upon the insured's death are not included in the beneficiaries' taxable income. A life insurance policy provides benefits to your family if you die. An It is likely you will also be subject to a new surrender period before you can. Spouses can roll over inherited (k) assets into an inherited IRA. The IRS waives any early withdrawal penalties for owners of inherited IRAs so they can. Yes, spousal beneficiaries may roll over all or part of the proceeds of a before-tax (b) or Traditional IRA account to a Traditional IRA, SEP IRA, (k), or. Unlike spousal beneficiaries, non-spouses must establish an inherited IRA as the IRS does not allow you to roll over the money from the deceased IRA into your. For instance, people may invest their IRA savings in life annuities and begin drawing benefits when they retire. The proceeds of a life insurance policy can. Defined Contribution Plans – The total death benefit under a DC plan will never exceed the account balance. Since the life insurance must be take into account. In addition to life insurance payments, you can also log in to pay on loan Can Prudential automatically deposit the funds into my bank account? Yes. I cashed my life insurance policy in On my from distribution it indicates that a portion of it was an IRA withdrawal and is taxable. Non-spouse beneficiaries of a (b) plan have the option of moving the assets to an inherited (b), roll over to an inherited IRA or take a lump-sum. Bear in mind, though, that the IRS gives you just 60 days after you receive a retirement plan distribution to roll it over to an IRA or another (k) plan. If.

Offshore Day Trading Platforms

We recommend Fidelity as the best international trading platform for beginners. In addition to user-friendly platforms, Fidelity offers extensive research and. Schwab's thinkorswim — The Former TD Ameritrade Options Trading Platform; Power E-Trade — The Fast Executions Options Trading Platform; Interactive Brokers'. Are you looking for offshore brokers you can use to trade with? Make sure you're looking at CMEG, eToro and Plus as options. Traders and investors use Capital Markets Elite Group because of our sophisticated platforms and experienced team. Trade with less limits. Offshore futures trading online with Euro Pacific Bank. Our daily research on the Futures markets available directly through Global Trading's platform. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. Online brokers with no PDT rule? The best brokers to avoid being a pattern day trader are CMEG Group and eToro. What is the best online broker for day trading?Interactive Brokers (IBKR) remains firmly entrenched as our overall pick as Best Online Broker for Day. You can trade world markets 24/7 using a tax-neutral international platform. Offshore Pro Group can arrange both corporate and personal brokerage accounts in. We recommend Fidelity as the best international trading platform for beginners. In addition to user-friendly platforms, Fidelity offers extensive research and. Schwab's thinkorswim — The Former TD Ameritrade Options Trading Platform; Power E-Trade — The Fast Executions Options Trading Platform; Interactive Brokers'. Are you looking for offshore brokers you can use to trade with? Make sure you're looking at CMEG, eToro and Plus as options. Traders and investors use Capital Markets Elite Group because of our sophisticated platforms and experienced team. Trade with less limits. Offshore futures trading online with Euro Pacific Bank. Our daily research on the Futures markets available directly through Global Trading's platform. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. Online brokers with no PDT rule? The best brokers to avoid being a pattern day trader are CMEG Group and eToro. What is the best online broker for day trading?Interactive Brokers (IBKR) remains firmly entrenched as our overall pick as Best Online Broker for Day. You can trade world markets 24/7 using a tax-neutral international platform. Offshore Pro Group can arrange both corporate and personal brokerage accounts in.

An offshore trading account offers many benefits that may or may not be available to you as an individual investor. It takes just a few days or hours to start. TradeZero commission free stock trading software lets you trade and locate stocks from any device and includes real-time streaming and direct market access. 6. Investor's Business Daily®, January Best Online Brokers Special Report. Fidelity was named Best Overall Online Broker, and also first in Trade. Offshore brokers may offer services restricted in certain jurisdictions. For US traders, this can mean access to Non-FIFO trading, CFD trading, and higher. Looking for somewhere to trade actively? We reviewed the best day trading platforms based on execution speed, ease of use, pricing, reliability. Made to trade · Featured · Featured · Featured · TradeStation · moomoo. Silver. Silver. Silver · AMP Futures. Platinum. Platinum. Platinum · hyrdaruzhpnew4af.online Platinum. All firms offer online access to some markets, but you will also be assigned a trading representative. When you want to trade a market that is not available. US and international traders (except those from Canada) can consider the offshore brokerages Day Trade Dash platform which is available only at Warrior. Best Offshore Forex Brokers for ; RoboForex · Wire Transfer Credit Cards PayPal Skrill Neteller Perfect Money Trustly iDeal Sofort Bitcoin Bitсoin Cash. An Offshore Forex Broker is a Broker that is operating from overseas in a country where the presence of less regulations and constraints makes it easier for. Explore our selection of top offshore forex brokers and platforms, meticulously evaluated by seasoned financial experts for compliance with regulations. Hugo's Way - The Best Offshore Brokers Overall · LQDFX - Top Range of Account Types · MidasFX - Top Offshore Broker With MetaTrader 4 · EAGLE FX - Great CFD. Top 5 offshore brokers for day trading in the USA · Interactive Brokers (IB) · ThinkOrSwim · TradeKing · TradeStation · Scottrade · Did you know? Lightspeed Financial provides low-cost stock and options on a fast-trading platform for active traders, professional traders, trading groups, and more. According to our research, SOLIDECN, Plexytrade, and N1CM are the best offshore Forex brokers for day trading. They offer most of the important day-trading. An offshore forex broker is a financial institution or company that operates in a foreign country and offers forex (foreign exchange) trading. Insights & Education · The latest commentary · Market updates · Investing Basics · Popular in trading · Planning and retirement · Schwab original podcasts · Onward. 3. No physical address, it's clearly fake, or offshore. If a centralized cryptocurrency or forex trading platform doesn't. Offshore international brokers are firms that do not have stringent regulatory frameworks like brokers regulated in the United States or Europe. These brokers. 1. Best Overall: CenterPoint Securities · 2. Best for No Spread on Forex: hyrdaruzhpnew4af.online · 3. Best for Global Traders: Interactive Brokers · 4. Best for Futures Trading.

Zazzle Check Order Status

Order History Here's where you find information about your current and previous Zazzle orders. You can check your order status, track your order, check order. Pay for your next purchase at Zazzle in 4 installments over 6 weeks when you check out with Zip. System Status · Terms of Service · Licenses · Vulnerability. To check on the progress of your package, please log into your Zazzle account and go to your Order History. Find the shipped order and click on the "Track. How Do I Cancel or Modify an Existing Order? Shipping Info · Order Statuses Explained Track My Order · Return Policy · Sitemap · Help · Careers · Zazzle Ideas. All you have to do is verify your student status with Student Beans and you'll get a discount code to use on your order. Zazzle Buy Now, Pay Later. Split. Temu Delivery Time · Temu Order Tracking Steps in Transit · Temu Said My Package Is at A Airport · Temu · Tracking Temu Orders · Temu Tracking Steps. Likes. Track your Zazzle order status with tracking number, Read Zazzle customer reviews for shopping guidance. And stay up-to-date with the latest Zazzle email. Find information on shipping options, rates, custom duties, and tracking for all products with international destinations here. Returns. If you don't love it we. Login to your Zazzle account · Click the profile icon, located at the top right of the Zazzle home page · Click on 'My Orders' · Click on the order id you want to. Order History Here's where you find information about your current and previous Zazzle orders. You can check your order status, track your order, check order. Pay for your next purchase at Zazzle in 4 installments over 6 weeks when you check out with Zip. System Status · Terms of Service · Licenses · Vulnerability. To check on the progress of your package, please log into your Zazzle account and go to your Order History. Find the shipped order and click on the "Track. How Do I Cancel or Modify an Existing Order? Shipping Info · Order Statuses Explained Track My Order · Return Policy · Sitemap · Help · Careers · Zazzle Ideas. All you have to do is verify your student status with Student Beans and you'll get a discount code to use on your order. Zazzle Buy Now, Pay Later. Split. Temu Delivery Time · Temu Order Tracking Steps in Transit · Temu Said My Package Is at A Airport · Temu · Tracking Temu Orders · Temu Tracking Steps. Likes. Track your Zazzle order status with tracking number, Read Zazzle customer reviews for shopping guidance. And stay up-to-date with the latest Zazzle email. Find information on shipping options, rates, custom duties, and tracking for all products with international destinations here. Returns. If you don't love it we. Login to your Zazzle account · Click the profile icon, located at the top right of the Zazzle home page · Click on 'My Orders' · Click on the order id you want to.

Order Status · Apple Trade In · Financing · College Student Offer. Shop Special → Track your order every step of the way. → Get app-exclusive deals on. Customs fees and taxes are the responsibility of the buyer. Tracking and Delivery Status: All orders can be tracked after they are shipped. You can use the. Check all hyrdaruzhpnew4af.online outages. hyrdaruzhpnew4af.online Server Status Check. hyrdaruzhpnew4af.online order to be remembered more easily, like a phonebook for websites. This. order and it had not shipped yet. Consequently, I called on Monday, July 30th to check on the status and see if my order would be shipped soon. I found. Orders · Instant Downloads · Order Status, Shipping · Design Tips · Placing an Order · Zazzle Chats · Specific Product Info · Returns & Refunds. Zazzle career & status discounts. Save up to 25% off at Zazzle with their student discount policy. Zazzle Students discount. Zazzle logo. Zazzle. Students. When you purchase a shipping label, we will also respond back with the tracking number for the label. You don't need to store the tracking number to get. Still have questions? Email us and our customer support agents will be happy to help. Zazzle - Create your moment. *ATTENTION* Some orders may take longer than anticipated due to current circumstances. We're working to get all shipments out safely. If you'd like information. Check out if you can find the solution you need. Confused as to if my order was placed. The email said when I clicked order status that What happened. Search Zazzle Help Center ; General Info. Contacting | Managing Accounts | Policies ; Orders. Shipping | Order Status | Designing | Checkout ; Selling. Creators |. All orders are fulfilled entirely by Zazzle and must be reviewed on their site. To track an existing order, please log into your Zazzle account and review your. I then waited and waited and my order finally was shipped. Only 5 days after if was supposed to arrive. Then once I got the tracking. Initial Complaint. 07/12/ Complaint Type: Delivery Issues. Status: Unanswered. Enter Zazzle Order Tracking code number to Check your Package, Courier, Shipping, Parcel status and Get Estimated delivery date info online. Order Desk gives you the ability to automate your order management process. By importing your Zazzle orders, you'll be able to split, filter and organize your. You can contact Zazzle support by calling You can also contact Zazl through their online form. You can use their FAQ section and their tracking. check and take action ([email protected] is where you Soon after I found all of them P4P copied and reuploaded on Zazzle in order. How Do I Cancel or Modify an Existing Order? Shipping Info · Order Statuses Explained Track My Order · Return Policy · Sitemap · Help · Careers · Zazzle Ideas. 4. Shipped:We have packaged your items and have handed your package to our trusted carriers. Please note that tracking code information for orders shipped with.