hyrdaruzhpnew4af.online

Gainers & Losers

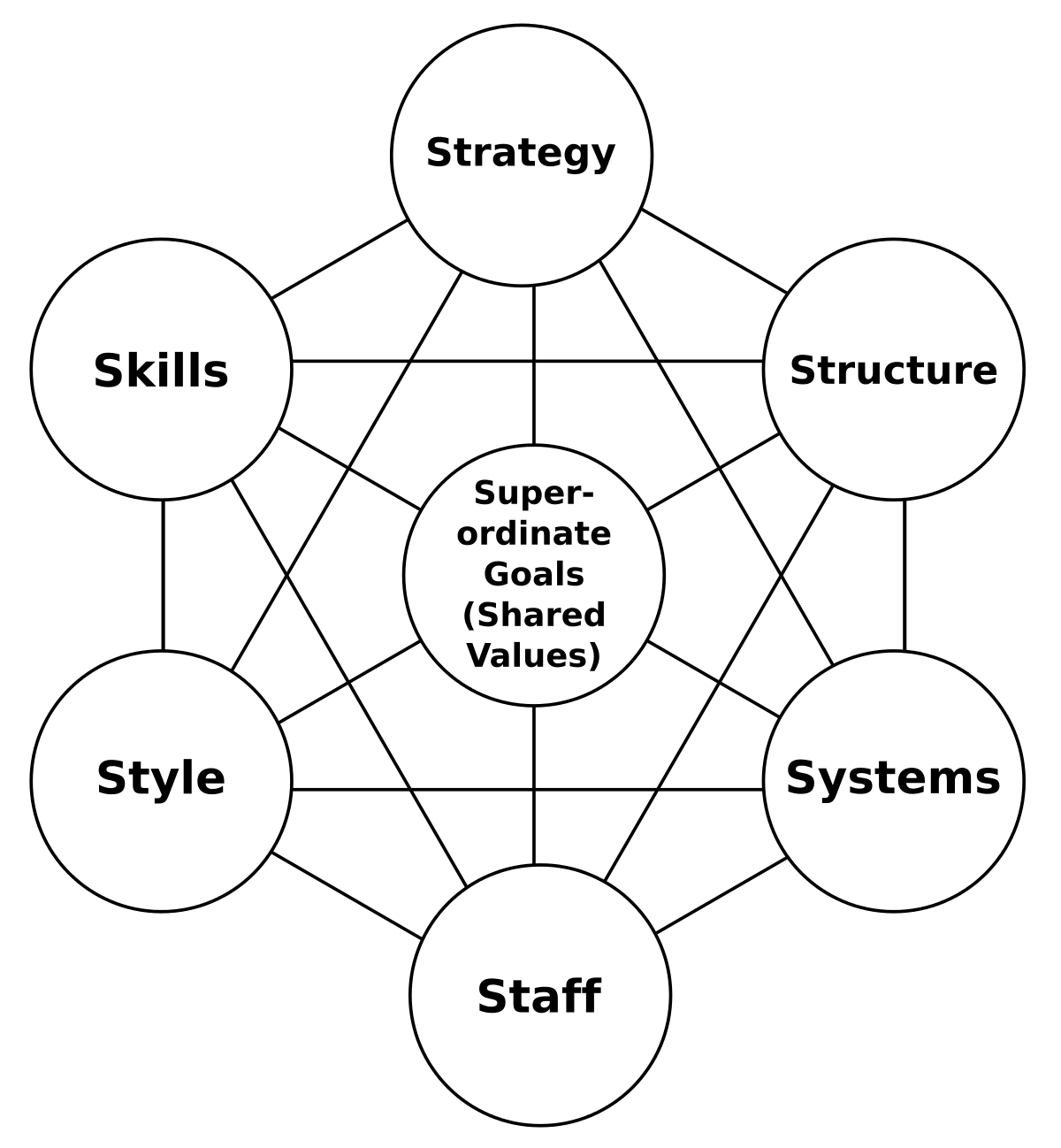

7s Of Mckinsey

With roots tracing back to studies conducted at McKinsey in the late 20th century, the 7S Framework focuses on seven elements: Strategy, Structure, Systems. The McKinsey 7S Framework is a diagnostic model refer to the seven elements or factors that start with the letter 'S'. What Are the 7S Factors? The seven factors in McKinsey's model are strategy, structure, systems, shared values, skills, style, and staff. In this article, we explore the McKinsey 7 S model with examples to give a better understanding of this model. We also recommend a one-stop tool to get you. The McKinsey 7S Framework is a management model developed by business consultants Robert H. Waterman, Jr. and Tom Peters in the s. What is the McKinsey 7S model? · Strategy: your organization's plan for succeeding in your field · Structure: your company's hierarchy and organization · Systems. The McKinsey 7S framework helps you assess seven key elements of your business that need to change or be aligned in order to be successful. McKinsey 7s is a tool to analyze company design by seven key factors internal elements: Structure, strategy, Systems, Skills, Style, Staff, and Shared Values. The McKinsey 7S Model helps you analyze your company for performance gaps. You can use this management model to identify the gap between how you are currently. With roots tracing back to studies conducted at McKinsey in the late 20th century, the 7S Framework focuses on seven elements: Strategy, Structure, Systems. The McKinsey 7S Framework is a diagnostic model refer to the seven elements or factors that start with the letter 'S'. What Are the 7S Factors? The seven factors in McKinsey's model are strategy, structure, systems, shared values, skills, style, and staff. In this article, we explore the McKinsey 7 S model with examples to give a better understanding of this model. We also recommend a one-stop tool to get you. The McKinsey 7S Framework is a management model developed by business consultants Robert H. Waterman, Jr. and Tom Peters in the s. What is the McKinsey 7S model? · Strategy: your organization's plan for succeeding in your field · Structure: your company's hierarchy and organization · Systems. The McKinsey 7S framework helps you assess seven key elements of your business that need to change or be aligned in order to be successful. McKinsey 7s is a tool to analyze company design by seven key factors internal elements: Structure, strategy, Systems, Skills, Style, Staff, and Shared Values. The McKinsey 7S Model helps you analyze your company for performance gaps. You can use this management model to identify the gap between how you are currently.

The McKinsey 7S Model serves as a guide for organizational analysis and strategy formulation. It emphasizes the need for alignment and balance among the seven. When it comes to applying McKinsey's 7S framework in the strategic management of change, you want to ensure that your change project activities are reflecting. McKinsey 7S model identifies seven elements that help organizations to achieve goals and implement change. See our worksheet and example of how to use 7S. What Are the 7S Factors? The seven factors in McKinsey's model are strategy, structure, systems, shared values, skills, style, and staff. The McKinsey 7S Framework is a management model developed by business consultants Robert H. Waterman, Jr. and Tom Peters in the s. The McKinsey 7S model is a framework that helps you assess seven key elements of your business's organizational design that need to change or be aligned in. The McKinsey 7-S framework in the s to assist organizations who are trying to understand the current state of their organization. The Seven-S framework of McKinsey is a Value Based Management (VBM) model that describes how one can holistically and effectively organize a company. Amazon McKinsey 7S model illustrates the ways in which seven elements of businesses can be united to increase effectiveness. According to this model. The McKinsey 7S Framework was created as a recognisable and easily remembered model in business. The seven variables, which the authors term "levers", all begin. McKinsey 7S Framework: Boost business performance, prepare for change and implement effective strategies (Management & Marketing) [50MINUTES,.]. The McKinsey 7-S framework helps you increase the efficiency of your organization, and how your PMO supports it. By determining what your business does well in. The 7S-Framework, created by the renowned consulting company McKinsey & Company, offers a thorough and all-encompassing method for understanding and evaluating. Abstract: Aim of this research was investigating and analyzing organizational structure free zone of. Qeshm based on 7 S of McKinsey. The McKinsey 7 S model details 7 organizational performance factors: systems, structure, strategy, shared values, skills, staff and style. McKinsey's 7s framework is a management and administration aid model designed by Tom Peters and Robert Waterman in the late s. With our McKinsey 7S Framework presentation, you can identify the weakest links in your venture's processes, improve performance, maintain alignment and manage. The McKinsey 7 S model is a very good way of examining an organisation, and identifying elements that may not be contributing effectively to success. It is. Download scientific diagram | McKinsey 7 S Model Placing Shared Values in the middle of the model emphasizes that these values are central to the. McKinsey 7S Framework is used to identify how well the area executes actions that align with business objectives. little limitations regardless of the size.

How To Take A Company Private

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription. When a company goes private, shares are often purchased at a premium and the company is delisted from public stock exchanges. Shareholders give up ownership in. The only answer I found is the person or company has to buy majority of public shares and then will make a set-price to buy off the rest. A “take private” transaction describes a transaction in which a publicly-traded company returns to being a private company and its shares are delisted from. Dole Food Company was taken private by David Murdock in When Murdock initiated the transaction he owned 40% of. Dole's common stock and served as its. Recent falls in equity markets mean that many listed companies may appear attractively priced, for a period at least. With significant levels of dry powder. Take-Private is the acquisition of a public company, whereby the target's shares are de-listed post-closing. -Private Transaction. SEATTLE, April 18, /PRNewswire/ -- private company. In response, the Board formed a special committee of independent and. Also known as a "going private" transaction or "public-to-private" (P2P) transaction. · The most common types of take-private transactions are: · There are many. A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription. When a company goes private, shares are often purchased at a premium and the company is delisted from public stock exchanges. Shareholders give up ownership in. The only answer I found is the person or company has to buy majority of public shares and then will make a set-price to buy off the rest. A “take private” transaction describes a transaction in which a publicly-traded company returns to being a private company and its shares are delisted from. Dole Food Company was taken private by David Murdock in When Murdock initiated the transaction he owned 40% of. Dole's common stock and served as its. Recent falls in equity markets mean that many listed companies may appear attractively priced, for a period at least. With significant levels of dry powder. Take-Private is the acquisition of a public company, whereby the target's shares are de-listed post-closing. -Private Transaction. SEATTLE, April 18, /PRNewswire/ -- private company. In response, the Board formed a special committee of independent and. Also known as a "going private" transaction or "public-to-private" (P2P) transaction. · The most common types of take-private transactions are: · There are many.

company, climbed the agenda. Rollovers Face Close Regulatory Scrutiny. A rollover refers to an arrangement in which a target shareholder is offered the. We take pride in growing our people and attracting talented individuals who share our purpose. We are committed to meeting high standards of corporate. great companies around the world. Bain Capital Private Equity pioneered the value-added investment approach. Our globally integrated teams leverage deep. Blackstone Private Credit Fund (BCRED). Build wealth with Blackstone. Build Company. Job Title. Market Commentary & Insights. Press Releases & Firm. The simplest way for a public company to go private is for the company to de-register its securities – a process known as “going dark.” The SEC allows a company. Funds buy outstanding portions of private companies or struggling public companies by buying out shares and delisting. take on more responsibility in. We invest alongside our clients and take a Apollo's Hybrid team partnered with Global Schools Group, a leading private international education company. Deciding when and how to take a private company public is one of the biggest decisions a founder and CEO, his or her leadership team and board will make. Accelerate your future with Forge's private market solutions. Get access to pre-IPO investment opportunities and liquidity for your private company shares. Incorporate a private limited company - register it with Companies House do not usually take profit from the company - instead the money is kept. • Sponsor take-private: an acquisition of a public company by a private equity sponsor, typically in a leveraged buyout transaction. • Controller take. There are several ways for a Canadian public company to become a private company and de-list its securities from the Canadian public market trading systems. If the seller is a willing seller, then the private take-over is easier, much less regulatory oversight. Legal and accounting costs will be. We can't wait to see what you build. Request a demo Take a video tour Private Equity · Accelerators · Partner Resources · Startup Stack. Company. About us. Bank of America, N.A., and U.S. Trust Company of Delaware (collectively the “Bank”) do not serve in a fiduciary capacity with respect to all products or. of such companies is when to take the company public? Trying to time the IPO market is akin to timing a slump or spike in stock indexes. So what is a private. Warburg Pincus LLC is a leading global growth investor. The firm has an active portfolio of more than companies and is headquartered in New York. taking advantage of depressed public equity valuations to execute take-private transactions. They do not necessarily reflect the views of any company in the. As a private company, your investors are probably people you know—friends, family, and maybe a few angel investors. In a public company, however, shares are. A “take private” transaction describes a transaction in which a publicly-traded company returns to being a private company and its shares are delisted from.

Best Cold Crypto Wallet 2021

Ballet Real Bitcoin - The Easiest Crypto Cold Storage Card - Cryptocurrency Hardware Wallet with Secure Multicurrency and NFT Support, (Single) (1). Guarda Wallet is a highly secure and user-friendly cryptocurrency wallet that allows users to buy, store, swap, and earn a wide range of crypto assets. Coinbase Wallet · Windows, Android, iOS, Mac · Hot Wallet · Incorporated exchange · Hardware wallet compatible · Cloud storage · Cold storage · Free · Coinbase Inc. Safepal hardware wallet, which has been in production since in collaboration with Binance, quickly became popular among cryptocurrency enthusiasts and. Without a doubt, MetaMask is the most popular digital wallet in the crypto space with over 21 million users worldwide. There is even a swap function that allows. As a beginner, you may get cold wallets like the Trezor Model One and the Ledger Nano S. You may not need fancy features if you don't have that many cryptos. A. coolwallet best wallet. CoolWallet Pro is a next-generation cold-wallet device developed by CoolBitX, a Taiwanese tech company. Released in May , it. 1. What is the best cold storage wallet? · KeepKey: KeepKey is a no bells/whistles block-style cold key perfect for beginners. · SafePal: At the same price as. The safest cold storage wallets for crypto security and financial independence. Easily use, store, and protect Bitcoins. Ballet Real Bitcoin - The Easiest Crypto Cold Storage Card - Cryptocurrency Hardware Wallet with Secure Multicurrency and NFT Support, (Single) (1). Guarda Wallet is a highly secure and user-friendly cryptocurrency wallet that allows users to buy, store, swap, and earn a wide range of crypto assets. Coinbase Wallet · Windows, Android, iOS, Mac · Hot Wallet · Incorporated exchange · Hardware wallet compatible · Cloud storage · Cold storage · Free · Coinbase Inc. Safepal hardware wallet, which has been in production since in collaboration with Binance, quickly became popular among cryptocurrency enthusiasts and. Without a doubt, MetaMask is the most popular digital wallet in the crypto space with over 21 million users worldwide. There is even a swap function that allows. As a beginner, you may get cold wallets like the Trezor Model One and the Ledger Nano S. You may not need fancy features if you don't have that many cryptos. A. coolwallet best wallet. CoolWallet Pro is a next-generation cold-wallet device developed by CoolBitX, a Taiwanese tech company. Released in May , it. 1. What is the best cold storage wallet? · KeepKey: KeepKey is a no bells/whistles block-style cold key perfect for beginners. · SafePal: At the same price as. The safest cold storage wallets for crypto security and financial independence. Easily use, store, and protect Bitcoins.

Good Cold Wallet: Ledger · Mac OS, Windows, Linux, iOS, Android · 1,+ (all the big ones and more) ; Good for beginners: Coinbase · iOS and Android, Windows, Mac. Safepal hardware wallet, which has been in production since in collaboration with Binance, quickly became popular among cryptocurrency enthusiasts and. wallet”? Hackers have pretty much given up on hacking corporations to steal data when the hack of a cryptocurrency exchange will net them so much more. In Best Cold Storage Options for Cryptocurrencies · 1. Cryptocurrency Hardware Wallets (safest) · 2. Paper Wallets · 3. Storing Cryptocurrency in USB Drive (Not so. The Ballet REAL Series Cold Storage card is an easy, safe, reliable cryptocurrency storage solution designed for ordinary people of all ages and backgrounds. Cold wallets mainly include computer wallets, paper wallets and hardware wallets. Among them, hardware wallets are the most used, which refers to hardware. Coinbase Wallet · Store and manage all of your crypto, NFTs, and multiple wallets in one place · Support for Bitcoin, Ethereum, Solana, Dogecoin, and all Ethereum. Cold Wallet Bitcoin(7) · Ballet REAL Series Bitcoin Cold Storage Wallet Card · Trezor Model One - Crypto Hardware Wallet - The Most Trusted Cold Storage for. Supports both cold and hot wallet storage and trading, features secure in-app Web3 browser, and analyzes Dapp interactions with its integrated Web3 Smart. They are cryptocurrency wallets that do not connect to the internet, thereby making them safe from any cyber-attacks or hacking attempts. On the. Secure your crypto assets such as Bitcoin, Ethereum, XRP, Monero and more. Give yourself peace of mind by knowing that your cryptocurrencies are safe. Those interested in the safest storage should consider using a non-custodial cold hardware wallet for all of their long-term bitcoin and cryptocurrency storage. Wondering what the best cryptocurrency wallet for you is? In this guide, we'll break down the best software and hardware wallets for investors in Trezor Model T is a second generation hardware wallet that allows you to store your Bitcoin (and many other cryptocurrencies) offline, complete in-wallet. Safepal hardware wallet, which has been in production since in collaboration with Binance, quickly became popular among cryptocurrency enthusiasts and. Ledger Nano X – Best Overall Cold Storage Wallet. Ledger hardware wallets stand as industry leaders in cryptocurrency wallet hardware technology and their. The Ledger Nano S Plus is one of the best crypto hard wallets you can buy. Ledger Nano Plus. Exceptional value for the price; Huge improvement over. Some of the most popular hardware wallets include Ledger, Trezor, and Coldcard. The lower end models typically sell for around $40 to $59 while the high-end. A cold wallet, also referred to as a hardware wallet, is a physical device designed to securely store your private keys offline. It acts as a. Among cold wallets, the Ledger Nano S is considered the best solution currently. · Expensive solution, costing $95 per unit.

What States Have The Lowest Sales Tax

Not counting the five states without general sales taxes, the lowest sales tax in USA is Colorado, which has a state sales tax rate of % (as of January ). Both states maintained local taxes on grocery food, though. Similarly, the state does not tax grocery food, but local governments do in Arizona, Georgia. As of , 5 states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not levy a statewide sales tax. California has the highest base sales tax rate. Almost all states employed a statewide sales tax, which ranged from percent in Colorado to percent in California. Only five states did not have a. The Nebraska state sales and use tax rate is % ). · Nebraska Jurisdictions with Local Sales and Use Tax. This is in addition to the state sales tax, use tax, and local option tax, if any. have a lower fuel tax rate. Additionally, biodiesel B to B How to Use This Chart ; Vermont. % The state has reduced rates for sales of certain types of items. 0% – 1% Some local jurisdictions do not impose a sales. Statewide Tax Rates, Code, Effective Date, Rate. State Sales and Use Tax, -, 07/01/, %. State Reduced Food Tax, -, 01/01/, %. State Tax Rates ; SALES TAX, FARM, % ; SALES TAX, GENERAL \ AMUSEMENT, % ; SALES TAX, FOOD/GROCERY Effective September 1, , % ; SALES TAX, MFG. Not counting the five states without general sales taxes, the lowest sales tax in USA is Colorado, which has a state sales tax rate of % (as of January ). Both states maintained local taxes on grocery food, though. Similarly, the state does not tax grocery food, but local governments do in Arizona, Georgia. As of , 5 states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not levy a statewide sales tax. California has the highest base sales tax rate. Almost all states employed a statewide sales tax, which ranged from percent in Colorado to percent in California. Only five states did not have a. The Nebraska state sales and use tax rate is % ). · Nebraska Jurisdictions with Local Sales and Use Tax. This is in addition to the state sales tax, use tax, and local option tax, if any. have a lower fuel tax rate. Additionally, biodiesel B to B How to Use This Chart ; Vermont. % The state has reduced rates for sales of certain types of items. 0% – 1% Some local jurisdictions do not impose a sales. Statewide Tax Rates, Code, Effective Date, Rate. State Sales and Use Tax, -, 07/01/, %. State Reduced Food Tax, -, 01/01/, %. State Tax Rates ; SALES TAX, FARM, % ; SALES TAX, GENERAL \ AMUSEMENT, % ; SALES TAX, FOOD/GROCERY Effective September 1, , % ; SALES TAX, MFG.

You need to contact your software vendor if you use software to create your forms. To verify your new combined sales tax rate (i.e., state and local sales taxes). If you do find yourself in Alaska, you can also enjoy no state sales tax. However, localities can charge their own sales tax, so don't be surprised if your. The state use tax rate is %. Cities and counties may impose an additional local use tax. The amount of use tax due on a transaction depends on the combined. Sales Tax Rate Map. Find the Rate Error. Please select location within Minnesota Local General Sales & Use Tax Rates. Total Sales Tax Rate: None. State Tax. California City & County Sales & Use Tax Rates (effective July 1, ) Español ; Alameda County, %, Alameda ; Albany, %, Alameda ; Alhambra, %. sales tax rate, a % West Virginia state use tax is due. Because the 1% Williamstown use tax rate is lower that the local sales tax rates imposed in Ohio. Total General State, Local, and Transit Rates Tax Rates Effective 10/1/ Historical Total General State, Local, and Transit Rate Tax Rates & Tax Charts. Statewide Tax Rates, Code, Effective Date, Rate. State Sales and Use Tax, -, 07/01/, %. State Reduced Food Tax, -, 01/01/, %. The statewide grocery food sales tax rate is 3 percent. The following flow chart will help you decide what should be taxed at this lower rate. Among the 45 states that assess state sales and use taxes, Colorado's tax rate is the lowest in the country. When comparing both state and local government. The sales tax rate for most locations in Virginia is %. Several areas have an additional regional or local tax as outlined below. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. Effective: | | | | | | |. You need to contact your software vendor if you use software to create your forms. To verify your new combined sales tax rate (i.e., state and local sales taxes). Nine of the 10 most populous states have authorized local sales taxes (Exhibit 1). Among those with local taxes, only Florida's maximum local rate is lower than. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note. Local, state, and federal government websites often end hyrdaruzhpnew4af.online State of Georgia government websites and email systems use “hyrdaruzhpnew4af.online” or “hyrdaruzhpnew4af.online” at the. The statewide tax rate is %. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Almost all states employed a statewide sales tax, which ranged from percent in Colorado to percent in California. Only five states did not have a. Local, state, and federal government websites often end hyrdaruzhpnew4af.online State of Georgia government websites and email systems use “hyrdaruzhpnew4af.online” or “hyrdaruzhpnew4af.online” at the. States with the lowest taxes · Alaska · Florida · Nevada · South Dakota · Texas · Washington · Wyoming.

Best Mom Jeans For Curvy

best jeans for curvy women, we also make stylish choices. Shop Plus Size Taper Leg & Mom Jeans Collection from Fashion Nova. Top Sellers. -- Keep Coming Back Boyfriend Jeans - Light Blue. I finally came around to love these light wash mom jeans from Fashion Nova. They were much more fitted and structured than the distressed mom jeans I first. Shop Best Jeans For Curvy Women at Myer. Become a MYERone Member Today & Earn 2 credits for every $1 spent at Myer. Like our mums, Levi's women's mom jeans are perfect for everything. They're a great addition to your workwear and are comfy enough as relaxing loungewear. Curve Love High Rise Mom Jean in a big way. Our curvy mom jeans offer a flattering fit, relaxed around the thighs with a tapered leg from the knee down. Available in US sizes Shop Women's Curvy Jeans and see our entire collection of women's high-waisted curvy jeans and more. Free shipping & returns for Madewell Insiders. The Madewell curvy perfect vintage jeans is my go to. They have a high 10” rise to pull in the tummy. I get the petite length so they hit at the ankle. best jeans for curvy women, we also make stylish choices. Shop Plus Size Taper Leg & Mom Jeans Collection from Fashion Nova. Top Sellers. -- Keep Coming Back Boyfriend Jeans - Light Blue. I finally came around to love these light wash mom jeans from Fashion Nova. They were much more fitted and structured than the distressed mom jeans I first. Shop Best Jeans For Curvy Women at Myer. Become a MYERone Member Today & Earn 2 credits for every $1 spent at Myer. Like our mums, Levi's women's mom jeans are perfect for everything. They're a great addition to your workwear and are comfy enough as relaxing loungewear. Curve Love High Rise Mom Jean in a big way. Our curvy mom jeans offer a flattering fit, relaxed around the thighs with a tapered leg from the knee down. Available in US sizes Shop Women's Curvy Jeans and see our entire collection of women's high-waisted curvy jeans and more. Free shipping & returns for Madewell Insiders. The Madewell curvy perfect vintage jeans is my go to. They have a high 10” rise to pull in the tummy. I get the petite length so they hit at the ankle.

Snag a pair of comfy curvy jeans for women at Hollister with more room in the hips and thighs for a feel good fit. Available in a range of styles. Shop the latest collection of mom jeans at Old Navy. Find the perfect fit Curvy High-Waisted OG. ASOS Curve offers plus-size jeans in every style, from plus-size wide-leg jeans in blue to extra-slouchy dad styles with big rips – there's something for. Yes, curvy people can wear mom jeans. These jeans fit snugly at the waist and widen at the hips, enhancing an hourglass shape. They work well to show off your. Have you tried Madewell's curvy petite jeans? They were recommended to me by someone who is curvy and short - I'm average height but short. cute styles for my curvy friends. May 25th, cute mom jeans for moms. I haven't done a fashion post in quite a bit, so I thought I'd do a quick one. Casual, comfortable and fashionable style. These juniors' destructed curvy mom jeans from SO are just the pants you've been looking for to complete your. Versatile & stylish, mom jeans are here to stay! Find them from all the best brands like Arizona online at JCPenney. Free shipping & curbside pickup. Find and save ideas about plus size mom jeans on Pinterest. Inspired by a retro 90s silhouette, our plus size mom jeans are a firm favourite in our wardrobe every season. Our curvy mom jeans offer a flattering fit. For a more 90s vibe, ripped and distressed mom jeans are the way to go. They're like the best of both worlds - cool and collected with the mom style, with a. Chicago Plus Size Petite Fashion Blogger Natalie Craig Natalie in the City reviews mom jeans and silk bandana tops from Fashion Nova. Reasons to Love Your Curvy Fit Jeans Curvy jeans are the go-to option if you're looking for the ideal blend of a comfortable fit and great on-trend looks. Having the best high waisted jeans for curves is a start, but you should give yourself the option of a mid-rise pair, a black denim skinny jeans, and more. A. Levi's® Women's Mom Jeans are a modern twist on classic styles that have defined generations. Shop Women's Mom Jeans at Levi's® US for the best selection. PLUS SIZE HIGH RISE GRINDED MOM JEANS Bayeas · Medium Blue ; Plus Size High Rise Flare Jeans Vervet by Flying Monkey · DEW DROP ; Full Size Chelsea Midrise Crop. Keep it cool and casual with boohoo USA's range of plus-size mom jeans. Browse the collection and find yours today. Browse a range of Women's Mom Jeans at Just Jeans in a variety of fits from super skinny, classic straight & bootcut styles. Shop online and in-store. Curve Love High Rise Mom Jean in a big way. Are plus size mom jeans flattering? The short answer: No. However, I am so over dressing for flattery—as are many plus size women. Flattering clothing is.

How To Cancel Credit Card Without Affecting Credit Score

Closing a Credit Card Without Hurting Your Credit Score Thinking about closing that credit card? If you're struggling to pay off credit card debt closing a. One way to salvage your credit score from dipping when you close a credit card is by opening new credit. This way, your credit history will increase and. 1. Pay off the remaining balance on the card, or transfer the balance to another credit card. 2. Contact the credit card company, preferably by phone. Conversely, closing a more recent credit card account will likely have less of an impact on your credit score. Can I check my credit score without lowering it? In this case, not making your credit card minimum payments will negatively impact your score more than paying off the balance and closing the credit card. If you want to close a card but can't afford to pay it off entirely at the moment, you could consider a balance transfer. That's when you use one credit card to. Closing a credit card can impact your credit utilization ratio, potentially dinging your credit score. Credit utilization measures how much of. If you're thinking of canceling, be sure to consider the implications it could have to your credit score including your credit utilization ratio and the age of. Once you pay the dues to the bank or respective lenders than you can close the credit card without hurting your credit score. Closing a Credit Card Without Hurting Your Credit Score Thinking about closing that credit card? If you're struggling to pay off credit card debt closing a. One way to salvage your credit score from dipping when you close a credit card is by opening new credit. This way, your credit history will increase and. 1. Pay off the remaining balance on the card, or transfer the balance to another credit card. 2. Contact the credit card company, preferably by phone. Conversely, closing a more recent credit card account will likely have less of an impact on your credit score. Can I check my credit score without lowering it? In this case, not making your credit card minimum payments will negatively impact your score more than paying off the balance and closing the credit card. If you want to close a card but can't afford to pay it off entirely at the moment, you could consider a balance transfer. That's when you use one credit card to. Closing a credit card can impact your credit utilization ratio, potentially dinging your credit score. Credit utilization measures how much of. If you're thinking of canceling, be sure to consider the implications it could have to your credit score including your credit utilization ratio and the age of. Once you pay the dues to the bank or respective lenders than you can close the credit card without hurting your credit score.

In this case, not making your credit card minimum payments will negatively impact your score more than paying off the balance and closing the credit card. Canceling a credit card could downgrade your credit utilization ratio, meaning that any debts you hold will make up a larger percentage of your available credit. Pay off all your credit card accounts (not just the one you're canceling) to $0 before canceling your card, you can avoid a decrease in your credit score. Cancelling a credit card does not ruin your credit. It does not lower your credit score due to age. Again, cancelling a card does not ruin your credit or lower. There are two main ways closing a card can affect your credit score. One involves your credit usage rate and the other involves the age of your credit. To cancel your credit card, call your credit card company and ask to close your account. You will also need to bring your balance to zero. NAB suggests that if you have cleared your credit card's balance, keeping it open with no negative reports, will impact favourably on your overall score. The. Canceling your card takes away from this limit. The impact on your credit score depends on how big your credit limit was on the card you closed, but it can be. Cancelling a credit card with a long history of punctual payments can also be damaging to your credit score! If you're looking to apply for a loan anytime in. FICO® Credit Score and credit report plus score ingredients and tips. Personalized credit monitoring alerts if Experian® detects an event that may impact your. To cancel your credit card, call your credit card company and ask to close your account. · Canceling a credit card without hurting your credit score is a bit. The answer depends on your unique credit situation. Before you close a credit card account, consider the following. The short answer is no. We never recommend closing a credit card for the sole purpose of raising your FICO Score. The decision to close down credit cards. A new credit card might help reduce your credit utilization ratio and improve your credit mix—which could positively impact your scores over time with. Experts agree that canceling a credit card does not remove it from your credit reports immediately. The only way for the card's age to lose its value is for it. CONSIDER AGE OF THE CARD: Closing your oldest card can cause your credit history to appear shorter, which may harm your credit score. 2. CANCEL ALL AUTO-. Can closing a credit card affect your credit score? · Keep closer track – with fewer accounts to manage, the risk of making other mistakes which could affect. It may seem counterintuitive, but this is actually a bad idea. Closing an unused credit card increases your utilization rate (the percentage of your available. Canceling your card takes away from this limit. The impact on your credit score depends on how big your credit limit was on the card you closed, but it can be. Contact your credit card company to find out its procedure for closing an account. (This process may vary from company to company.) Credit score misconceptions.

Good Forex Strategies

Generally trend trading is one of the most reliable and simple Forex trading strategies. As the name suggests, this type of strategy. A Retracement refers to a TEMPORARY reversal in price within a major price trend. In terms of trading, retracements help to confirm trends and find great trades. In this Forex trading strategies guide, we go through 8 forex strategies that work to help boost your trading this year and how to get started today. Forex — the foreign exchange (currency or FOREX, or FX) market is the biggest and the most liquid financial market in the world. It boasts a daily volume of. Here is a closer look at how to develop a forex trading strategy as a beginner and the methods for testing and perfecting it. The best times to trade these currencies are during overlapping sessions between the major global forex markets. During periods of high trading volumes, forex. For me supply and demand with price action works the best and to be honest it is the easiest of them all. Moving Average + Stochastic This is one of our favorite and most popular trading strategies for short-term trading, and often for long-term signals as well. This guide is your gateway to understanding various forex trading strategies that align with distinct trading styles and market dynamics. Generally trend trading is one of the most reliable and simple Forex trading strategies. As the name suggests, this type of strategy. A Retracement refers to a TEMPORARY reversal in price within a major price trend. In terms of trading, retracements help to confirm trends and find great trades. In this Forex trading strategies guide, we go through 8 forex strategies that work to help boost your trading this year and how to get started today. Forex — the foreign exchange (currency or FOREX, or FX) market is the biggest and the most liquid financial market in the world. It boasts a daily volume of. Here is a closer look at how to develop a forex trading strategy as a beginner and the methods for testing and perfecting it. The best times to trade these currencies are during overlapping sessions between the major global forex markets. During periods of high trading volumes, forex. For me supply and demand with price action works the best and to be honest it is the easiest of them all. Moving Average + Stochastic This is one of our favorite and most popular trading strategies for short-term trading, and often for long-term signals as well. This guide is your gateway to understanding various forex trading strategies that align with distinct trading styles and market dynamics.

Only use the money you can afford to lose. Adapt your risk management to your trading style. Use the right position size. Always use stop-loss and limit orders. This course will provide you with the best 5 Forex strategies I have created during the years. As a professional trader, I use automated and manual trading. Crucial Rules to Remember When Using a Forex Trading Strategy · No Strategy is Perfect: · Follow Money Management Principles: · Be Realistic with Profit Targets. Scalping is among the best forex day trading strategies for beginners. However, it needs confident traders who can make quick decisions in the market. This is. The main strategies of forex trading are the same as for other markets: scalping, day trading, swing trading and position trading. Scalping and day trading. In Forex Strategies Resources the best forex hyrdaruzhpnew4af.online also Binary options strategies. Forex Strategies for all traders. Forex swing trading strategies are best suitable for traders who do not have a lot of time in their hand but has ample patience to keep the trades open. What is the Best Strategy for Trading Forex? · Day Trading: This strategy involves buying and selling financial instruments within the same trading day. · Swing. Some good Forex exchange trading strategies · Fibonacci retracement: Using the mathematical Fibonacci's sequence of numbers, you are required to identify a major. Placing buy limit and sell stop orders help employ a price control strategy on forex trades. Let's take a look at buy limit vs sell stop orders. The Best Time. There are different forex strategies that you can always apply in forex trading to minimize losses and make profits. Here they are. Forex Trading for Beginners: 3 Profitable Strategies for · 1) Pin Bar Trading Strategy (Beginner-Friendly). When it comes to Forex trading for beginners. Define Goals and Trading Style · The Broker and Trading Platform · A Consistent Methodology · Determine Entry and Exit Points · Calculate Your Expectancy · Focus and. What Are the Best Forex Trading Strategies? · Works best in a low-volatility market · Very approachable for new traders · Very little time is required · Favorable. Among all the strategies, Scalping works the best. I am experienced now and can handle it well. Though I will not suggest this strategy to. I'll walk you through what is it, how it works, the pros and cons, and how to decide which strategy is best suited for you. So let's get started Day trading. The best forex trading strategies for traders of skill levels. Learn about Swing Trading, Day Trading, FX indicators, Currency Pairs, Price Patterns + more. Learn about strategies such as: Forex scalping, support & resistance indicators, Forex swing trading, day trading, Bollinger Bands, and more! This article outlines 10 of the best forex trading strategies used by successful retail traders and institutional investors alike. We will discuss different technical trading strategies that are considered reliable and are followed by most traders.

Online Banking And Bill Pay

Make electronic payments with bill pay online. Receive digital bills directly to your account and pay them with mobile and online bill pay from U.S. Bank. Solved: I got an email saying I used wrong account number to make my payment last month. Tried to insert new one bill 14 digit account number but bank says. Online Bill Pay - Add your bills and make one-time or recurring bill payments all in one place. You decide who, when, and how much to pay. Online Banking; Mail-in Cheque or Money Order. Before proceeding with payment, please note the important numbers found on your hospital invoice. Track and schedule your bill payments, set up recurring payments, Expedite Payment1 and transfer money anytime in online banking through hyrdaruzhpnew4af.online or your mobile. Choose from many alerts such as: transaction monitoring on your debit card, bill pay payment reminder or when your account reaches or is below a set minimum. Make fast and easy bill payments online or with the Bank of America Mobile App. Not sure how to set up a Bill Pay? Try a self-guided demo to start. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more. Make electronic payments with bill pay online. Receive digital bills directly to your account and pay them with mobile and online bill pay from U.S. Bank. Solved: I got an email saying I used wrong account number to make my payment last month. Tried to insert new one bill 14 digit account number but bank says. Online Bill Pay - Add your bills and make one-time or recurring bill payments all in one place. You decide who, when, and how much to pay. Online Banking; Mail-in Cheque or Money Order. Before proceeding with payment, please note the important numbers found on your hospital invoice. Track and schedule your bill payments, set up recurring payments, Expedite Payment1 and transfer money anytime in online banking through hyrdaruzhpnew4af.online or your mobile. Choose from many alerts such as: transaction monitoring on your debit card, bill pay payment reminder or when your account reaches or is below a set minimum. Make fast and easy bill payments online or with the Bank of America Mobile App. Not sure how to set up a Bill Pay? Try a self-guided demo to start. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more.

Online Bill Pay. Make a time-consuming task easier. Pay your bills without. Digital Banking comes with the convenience of making one-time and recurring payments with Bill Pay. Save time with this no-cost personal deposit account. Pay bills · Set up post-dated bill payments · To stop payment on a cheque, you'll need to know the type of account the payment came from, payment amount, cheque. View, track and pay all your bills 1 in one secure place, with one password using US Bank bill pay. Log in and get started. An online bill pay service works by deducting a payment from your account balance and transferring it to a service provider. How to make online bill payments 1. Sign in. Sign in to Chase Online℠ or the Chase Mobile® app and sign up for Chase Online℠ Bill Pay. Choose “Pay Bills” in. Great customer service to us means giving you options when it comes to billing and payment. Icon: View Bill. View Bill · Icon: Online Banking. Online Banking. FirstBank's Online Banking gets you out of the line and banking in your favorite spot with the latest functionality, robust features and enhanced security. Online Banking. Mobile Banking. Make a bill payment by choosing Pay & Transfer > Pay Bills in the top navigation bar of online banking. Start by logging in to. Bill Pay is a free service that enables you to pay your credit card bill, cell phone bill, mortgage payment, utilities, individuals or really any bill you want. Bill Pay is a free, quick, and convenient way to pay your bills from Online Banking or the TD Bank app. Simple to set up and use, Bill Pay makes it easy to. With FNB Online Banking, you can bank securely on your schedule from anywhere you have Internet access! Transfer funds, pay bills, review account activity. Track and schedule your bill payments, set up recurring payments, Expedite Payment1 and transfer money anytime in online banking through hyrdaruzhpnew4af.online or your mobile. Pay all of your bills from one place—safely and securely. Find a branch Call Easy to Set Up Create your list of payees. Bill Pay is available to customers who have a Regions personal or small business checking or money market account. Learn more about how to pay bills online by. Log into Online Banking at hyrdaruzhpnew4af.online Click on the “Bill Pay” link at the top of the screen to get started. If you have any questions, please contact us. Pay your bills online with Wells Fargo's Bill Pay service. It's quicker and easier than writing and mailing paper checks. Online Banking; Telephone Banking; Automated Bank Machine; In Person (at your financial institution). Electronic Payment Program from American Express. As an. Pay your bills digitally with Huntington. It's simple. You tell us how much the payment should be and when to send–and we'll handle it all for you. For free. These days, everything is online — including your Home Bank accounts! Manage your money with ease no matter where you are. · Manage accounts online anytime.

Quickbooks Online Pros And Cons

Excellent online software I am very happy with this product. I use it for bookkeeping and my accountant reviews my entries at regular intervals. Pros. It is. I like that Quickbooks Online is such a widely used and trusted platform I can add clients seamlessly, run my own firm's financials quickly and clearly, and. The cons of QuickBooks Online are non-negligible. QuickBooks Online comes with a myriad of features, but they are expensive to maintain. "What impressed me most about QuickBooks Online is its robust feature set, encompassing everything from invoicing and expense tracking to payroll and tax. QuickBooks Online Disadvantages · Cost: · Complexity for Beginners: · Internet Dependency: · Limited Customization on Reports and Forms: · Integration Challenges. QBO is like a dumbed down version with less options to customize things. The downside of QB desktop being integrations are harder and often. QuickBooks Online vs. Desktop · Flexibility to work where you want** · Live collaboration · Multiple users included · Time-saving automation · Mobile app included**. It is a reliable software and easy to use. PROS. simple to use compared to others. Best for small business. CONS. for me there is no hyrdaruzhpnew4af.onlinehing. Reviews · Horrible customer Relations · QuickBooks Online saves the day! · Caution - check with other users in your industry · QuickBooks Online is more. Excellent online software I am very happy with this product. I use it for bookkeeping and my accountant reviews my entries at regular intervals. Pros. It is. I like that Quickbooks Online is such a widely used and trusted platform I can add clients seamlessly, run my own firm's financials quickly and clearly, and. The cons of QuickBooks Online are non-negligible. QuickBooks Online comes with a myriad of features, but they are expensive to maintain. "What impressed me most about QuickBooks Online is its robust feature set, encompassing everything from invoicing and expense tracking to payroll and tax. QuickBooks Online Disadvantages · Cost: · Complexity for Beginners: · Internet Dependency: · Limited Customization on Reports and Forms: · Integration Challenges. QBO is like a dumbed down version with less options to customize things. The downside of QB desktop being integrations are harder and often. QuickBooks Online vs. Desktop · Flexibility to work where you want** · Live collaboration · Multiple users included · Time-saving automation · Mobile app included**. It is a reliable software and easy to use. PROS. simple to use compared to others. Best for small business. CONS. for me there is no hyrdaruzhpnew4af.onlinehing. Reviews · Horrible customer Relations · QuickBooks Online saves the day! · Caution - check with other users in your industry · QuickBooks Online is more.

QuickBooks Online has enhanced its automated transaction categorization tool, which can be especially helpful to new users who have dozens or hundreds of. Although Quickbooks Online has a lot of useful features, there are some disadvantages with the pricing plan. Furthermore, I occasionally have to utilize other. Pros from reviewers · Efficient financial management · Organizational features · Straightforward accounting and taxation · Improved business operations · User-. Pros and Cons · Pros: QuickBooks simplifies accounting tasks, saves time, and provides valuable insights for businesses. · Cons: Some users may find the pricing. Pros of QuickBooks Online vs Desktop · Use anytime, anywhere with an Internet connection and login · No servers required on-premises · Reduces need for IT staff. QuickBooks is focused on small businesses. Small companies can grow bigger and earn good profits by using this software. Not using QuickBooks Enterprise? Try it. One of the biggest issues of using QuickBooks online is that Intuit -- the company that makes QuickBooks -- releases frequent updates. These updates can slow. Limited Functionality: While QuickBooks Online (QBO) is well suited for small to medium-sized businesses, it may not be an ideal fit for. QB pro has better accounting but QBO has better customer experience all around and it's cheaper. There is only one situation in which I would advocate to get. QuickBooks Online removes the hassle of remembering to back up your financials, as everything is automatically saved into the cloud. This means you'll never. Beware These QBO Bank Reconciliation Issues · QBO doesn't offer the functionality to record a payment to accounts payable or accounts receivable. · The ability. QBO has far better integrations than desktop. However these integrations can lead to tragic issues if not properly managed. QBO makes it very. Which Features Would Be Important While QuickBooks Online Comparison? 9,+ LinkedIn Fam | Certified QuickBooks · 1. Subscription Model: QuickBooks Online operates on a subscription basis, which can be more. Pros & Cons of Quickbooks · Keeping accurate financial records is an essential part of running your small business. · Large Support Network · Low Cost · Includes. Simplifies Tax Preparation and Compliance: Gone are the days of frantic tax season scrambles. QuickBooks Online alleviates tax time stress by tracking expenses. These two variants diverge significantly in their pricing structures; QuickBooks Online operates on a monthly subscription model, whereas QuickBooks Desktop. QuickBooks Desktop pros and cons · No internet connection required for some tasks and data access · Hundreds of industry-specific reports · Job costing and sales. QuickBooks is focused on small businesses. Small companies can grow bigger and earn good profits by using this software. Not using QuickBooks Enterprise? Try it. The user interface for QuickBooks Online Advanced is easy to navigate and is intuitive for novices. The screens are well laid out and have cohesiveness on each.

Real Estate Appraisal Fee

Home Appraisers We charge based upon the complexity of the appraisal, special requirements, etc. Fees can range up to $5, for especially complex. How Much is an Appraisal Fee When Buying a House in Arizona? While the cost of a home appraisal varies by the size and location of your home among other. Costs can vary depending on the individual appraisal company, location of the property, size and condition of the home and required details either by you or the. Fees · Full property appraisal in Los Angeles County (with comparables, single family dwelling using the URAR Form) is $ to $ · Full property appraisal. Fee schedule for Utah appraisals from Kranstover Appraisal Services including residential, multi family and lot appraisals. Real Estate Appraisal Fees In Houston Tx · $ - Rental Analysis ( & form) · $ - Proposed Construction Appraisal · $50 - Market Areas that lack. An appraisal fee is a payment made to someone to evaluate how much a home is worth. It is essentially a fee to estimate the value of the property. The Average Commercial Appraisal Cost Was $2, Nationally Per Latest Report If you ever wondered how much a commercial property appraisal costs then this is. Appraisal Fee. The appraisal fee is the amount of money that a professional appraiser will charge in order to determine the fair market value of a property. Home Appraisers We charge based upon the complexity of the appraisal, special requirements, etc. Fees can range up to $5, for especially complex. How Much is an Appraisal Fee When Buying a House in Arizona? While the cost of a home appraisal varies by the size and location of your home among other. Costs can vary depending on the individual appraisal company, location of the property, size and condition of the home and required details either by you or the. Fees · Full property appraisal in Los Angeles County (with comparables, single family dwelling using the URAR Form) is $ to $ · Full property appraisal. Fee schedule for Utah appraisals from Kranstover Appraisal Services including residential, multi family and lot appraisals. Real Estate Appraisal Fees In Houston Tx · $ - Rental Analysis ( & form) · $ - Proposed Construction Appraisal · $50 - Market Areas that lack. An appraisal fee is a payment made to someone to evaluate how much a home is worth. It is essentially a fee to estimate the value of the property. The Average Commercial Appraisal Cost Was $2, Nationally Per Latest Report If you ever wondered how much a commercial property appraisal costs then this is. Appraisal Fee. The appraisal fee is the amount of money that a professional appraiser will charge in order to determine the fair market value of a property.

Fee List ; Desk Review Form RARS, $ ; Preliminary Research & phone consultation, $ ; House Floor Plan, $ ; Appraisal Update Form D – Recert of. Home appraisals are an integral part of buying or selling a property in Ohio. They provide an unbiased assessment of a property's value and play a vital role in. The lender will order the final inspection once notification is provided (by the buyer, builder, or Realtor) that the house is fully constructed (or that all. Cost estimate includes home appraisal report and photos. Additional charges can be expected for non-typcial conditions. Reported by: ProMatcher Research Team. Real Estate Appraisal Fees In Houston Tx ; Single Family Residence ( – 2, sq ft). $ ; Single Family Residence (2, – 3, sq ft). $ ; Single Family. A New Jersey appraisal costs between $ and $, depending on the size of the property to be appraised and its state. The Buyer or the Seller, Who Pays for. A single-family house evaluation typically costs between $ and $ However, this can change depending on a variety of factors. These factors include the. Appraisals typically cost between $ and $, but appraisers will charge additional fees if they need to make multiple visits to the property for any reason. Appraisal cost for home appraisals in Phoenix, AZ and surrounding areas of Scottsdale, Chandler, Mesa, Gilbert and Maricopa & Pinal county. The borrower usually pays the appraisal fee, which averages $ to $ When the appraisal value is lower than expected, the transaction can be delayed or. After the review of the interior of the property has been completed, the fee will not exceed 50 percent of the posted fee. If the report is fully completed. Home Appraisers We charge based upon the complexity of the appraisal, special requirements, etc. Fees can range up to $5, for especially complex. Every appraisal can vary in terms of cost, but generally a home appraisal will cost between $$ With each situation there are differing levels of. The average price for a home appraisal is $ to $, with the average homeowner spending around $ for a single-family, 1, to 1, hyrdaruzhpnew4af.online home with a. Real Estate Appraisal Fee Schedule ; Value estimates to K · $ ; $ K - $1 M · $ ; $1 M - $ M · $ ; $ M - $2 M · $ ; $2 M+. Most appraisals are $ or less, even outside the primary service area, and can be completed in two days from the inspection. See our Fee Quote page for a. Typical Home Appraisal Cost ; Full House Appraisal on Single Family Home or Condo, $ ; Full Appraisal on Duplex, Triplex or Fourplex, $ ; Desktop Appraisal. Fees by Service · URAR Full Appraisal | $ - $ +/- · FHA Full Report | $ +/- · Exterior Only | $ +/- · Interior Inspection w/Sketch |. Private Use (Non-Lending) Appraisal Service Fees ; Full Desktop Appraisal (No Site Visit), $ ; Property Tax Dispute Appraisal, $ ; Investment Property (w/. You will find that the typical residential appraisal fees for a single-family home less than 2,sf is going to be between $ to $ Be leery if someone.